USDA Loans: Easy Guide for Rural Homebuyers

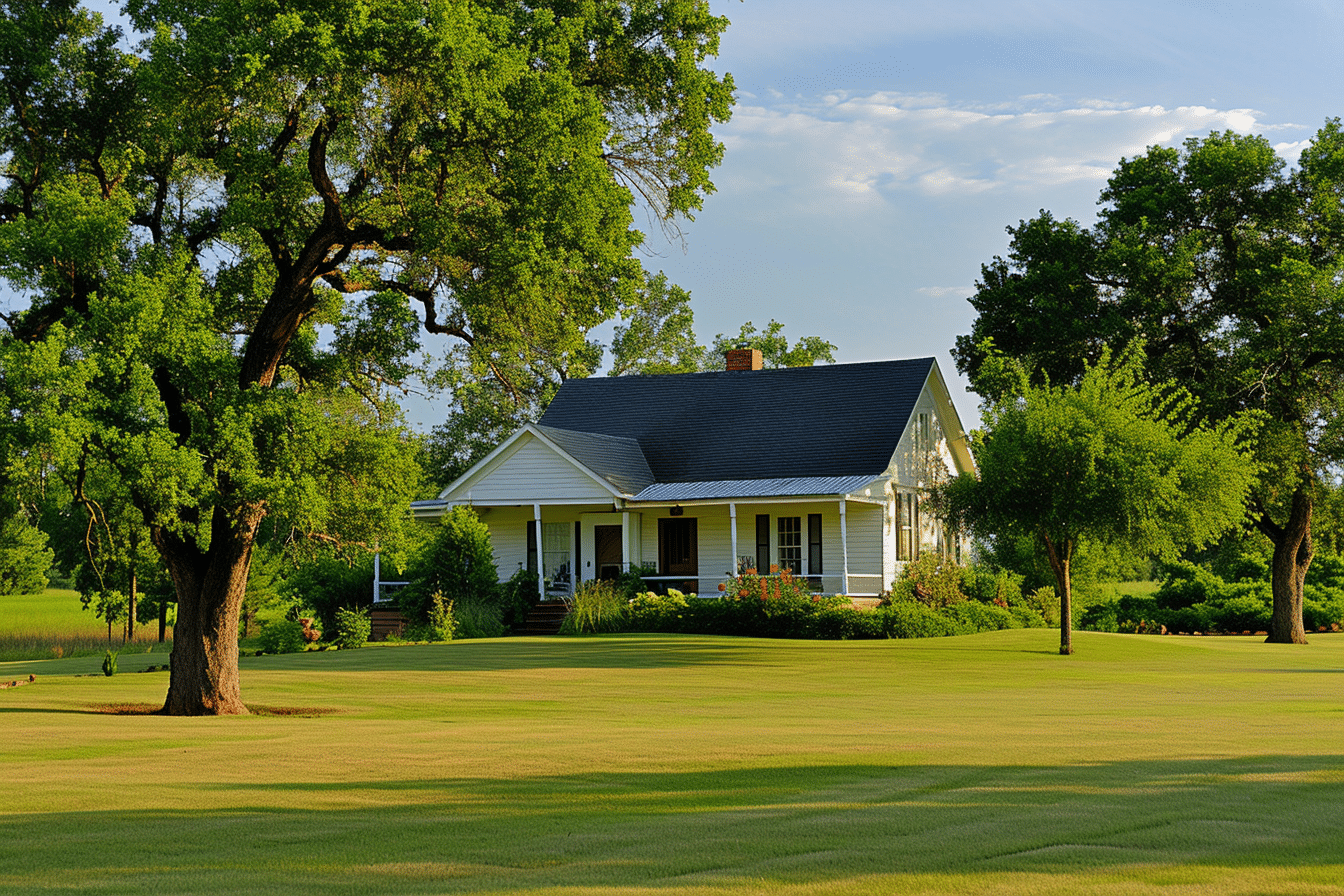

USDA Loans offer a unique opportunity for those looking to purchase a home in eligible rural areas of the United States. These government-backed loans, provided by the United States Department of Agriculture (USDA), were originally designed to promote homeownership and economic growth in rural communities. Over time, USDA Loans have become an attractive option for many, offering benefits such as no down payment requirements, competitive interest rates, and flexible credit guidelines.

The USDA Loan program offers various specialized loan options, creating opportunities for a range of income levels and property types. From first-time homebuyers seeking to escape the hustle and bustle of city life, to existing rural homeowners looking to improve their living conditions, these loans cater to the unique needs of rural America. It’s essential to understand the eligibility requirements, financial aspects, and application process of USDA Loans to fully appreciate the benefits and drawbacks they present.

Key Takeaways from USDA Loans

- USDA Loans support homeownership in rural areas with attractive benefits like no down payment requirements and competitive interest rates.

- The program offers specialized loan options catering to first-time homebuyers and existing rural homeowners.

- Understanding eligibility, financial aspects, and the application process helps potential borrowers make informed decisions about USDA Loans.

Understanding USDA Loans

What Are USDA Loans?

USDA loans are a type of mortgage loan designed to help people with low to moderate incomes purchase homes in rural and suburban areas. These loans are backed by the United States Department of Agriculture (USDA), with the goal of promoting homeownership and economic development in these regions. A significant advantage of USDA loans is that they offer zero down payment options and low mortgage rates. What is a USDA Loan? Am I Eligible for One?

Types of USDA Loan Programs

There are two primary USDA home loan programs available to eligible borrowers:

Single Family Housing Guaranteed Loan Program: This program assists borrowers in obtaining a mortgage through approved lenders. The USDA guarantees the loan, making it safer for lenders and more accessible for borrowers with lower credit scores or incomes.

Single Family Housing Direct Home Loans: Also known as the Section 502 Direct Loan Program, this program provides direct financial assistance to very low and low-income applicants, helping them purchase, build, renovate, or relocate a residence in an eligible rural area.

The Role of the USDA in Homeownership

The USDA plays a crucial role in promoting homeownership in rural and suburban areas by:

- Guaranteeing loans made by approved lenders, reducing the risk for lenders and making it easier for borrowers with lower credit scores and incomes to secure a mortgage.

- Offering financial assistance to very low and low-income applicants through the Single Family Housing Direct Home Loans program.

- Establishing eligibility requirements and guidelines for borrowers and properties to maintain fair, consistent, and equitable access to federal programs.

By providing these services and overseeing the USDA loan program, the USDA helps individuals and families achieve the dream of homeownership in rural and suburban areas across the US.

Eligibility Requirements

Income Eligibility and Limits

When it comes to USDA Loans, income plays a crucial role. These loans are designed to assist low-income borrowers, so there are specific income limits to be aware of. The limits vary by location, household size, and the type of loan program you choose. For most areas, a borrower’s adjusted gross income must be below 115% of the area’s median income for guaranteed loans.

For direct loans, the household income must fall between 50-80% of the area’s median income. To check your income eligibility, you can use the USDA’s income eligibility calculator. Always remember, meeting the income requirements is essential for securing a USDA loan.

Property Eligibility

Another vital factor for USDA loans is the property itself. First of all, the property must be located in an eligible rural area. A rural area typically has a population of 35,000 or fewer residents. If you’re unsure about whether a property is in an eligible rural area, you can visit the USDA’s property eligibility website and enter the property’s address.

Additionally, the property should be the borrower’s primary residence and meet certain basic health and safety requirements. It’s important to note that USDA loans can’t be used for income-producing properties, vacation homes, or properties with in-ground swimming pools.

Applicant Eligibility

Lastly, let’s talk about the applicant’s eligibility. In terms of citizenship, an applicant must be a U.S. citizen, a permanent resident, or an eligible noncitizen to qualify for a USDA loan. Other requirements include:

- Having a stable and dependable income for at least 24 months.

- Being able to afford the mortgage payments, taxes, and insurance. Generally, monthly payments should not exceed 29% of your monthly income.

- Having a credit score of at least 640 for a guaranteed loan. However, borrowers with lower scores may still be considered for a direct loan or get a credit score waiver.

These are just the basics of USDA loan eligibility requirements. To find out if you meet all the necessary criteria, it’s best to consult a loan specialist or reach out to your local USDA office.

Benefits and Drawbacks

Advantages of USDA Loans

USDA loans offer several advantages for those looking to achieve affordable homeownership in eligible rural areas. The most significant benefit is the zero-down-payment option, allowing borrowers to finance 100% of the home’s purchase price. This feature makes it easier for first-time homebuyers and those with limited savings to become homeowners.

Another advantage of USDA loans is the reduced Private Mortgage Insurance (PMI) compared to conventional mortgage options. Borrowers can also benefit from:

- Lower interest rates, making monthly payments more budget-friendly.

- Flexible credit requirements allowing those with less-than-perfect credit scores to qualify.

- Loan terms of up to 38 years for those with very low income, easing monthly mortgage payments even more.

Potential Disadvantages

Despite the many benefits, there are some potential drawbacks to USDA loans. One significant downside is the required upfront fee, which amounts to 1% of the loan amount. This fee can be rolled into the mortgage, but it still increases the total loan cost.

Additionally, USDA loans come with an annual fee of 0.35% of the remaining loan balance. This fee is paid monthly and can raise the mortgage payment slightly. It’s worth noting that this annual fee is typically lower than PMI on other loan types, but it’s essential to factor it into the overall cost.

Another possible downside is the limited property eligibility. USDA loans are only available in designated rural areas, which can limit options for homebuyers. However, it’s also worth noting that these loans cover a surprising number of properties because the USDA’s definition of “rural” is quite flexible.

In summary, USDA loans offer affordable homeownership opportunities but come with certain drawbacks. Potential borrowers should weigh the advantages and disadvantages to determine if a USDA loan is the best fit for their needs.

USDA Loans and Rural Development

Rural Development Objectives

USDA Rural Development, a division of the United States Department of Agriculture, focuses on improving the quality of life for individuals residing in rural areas. Their primary objectives include:

- Economic opportunity: Boosting business and job growth to sustain vibrant communities.

- Infrastructure: Ensuring access to essential services such as clean water, safe housing, and modern telecommunications.

- Innovation: Promoting innovation to drive economic growth and competitiveness.

Through various programs, USDA Rural Development consistently works towards the upliftment of rural communities and the overall prosperity of these areas.

How USDA Loans Promote Rural Prosperity

USDA loans serve as a powerful tool for promoting rural prosperity. They offer numerous benefits, such as:

- Affordable financing: USDA loans typically have lower interest rates and zero down-payment requirements, making them more accessible to potential rural homebuyers.

- Flexible credit guidelines: These loans accommodate borrowers who might struggle with meeting conventional loan credit requirements, ultimately allowing more rural residents to secure financing.

- Safety net: USDA loans contain provisions to protect borrowers in case of financial difficulties, such as payment assistance and moratoriums on foreclosures.

By providing affordable financing and flexible credit guidelines, USDA loans allow more individuals to invest in property within rural areas. Consequently, this encourages the growth of thriving communities and leads to increased economic activity within these regions.

Through their focus on rural development objectives and the use of USDA loans, USDA Rural Development plays a critical role in fostering prosperity within rural communities. This not only enhances the quality of life for residents but also contributes to the overall economic health of the nation.

Specialized USDA Programs

USDA loans cater to specific needs through their specialized programs. In this section, we will explore two of these programs: Single Family Housing Direct Home Loans and Rural Repair and Rehabilitation Grants.

Single Family Housing Direct Home Loans

The Single Family Housing Direct Home Loan is designed to help low- and moderate-income households purchase a decent and safe dwelling in eligible rural areas. Through the Single Family Housing Guaranteed Loan Program, approved lenders assist in providing the opportunity for these households to own their primary residence.

Some of the main features of this loan program include:

- 100% financing, which means no down payment is required

- Low-interest rates

- Payment assistance to help reduce monthly mortgage payments

This program truly makes it possible for eligible families to build or purchase a suitable home, even with limited financial resources.

Rural Repair and Rehabilitation Grants

For homeowners who already reside in rural areas, the USDA also offers Rural Repair and Rehabilitation Grants. These grants aim to help improve the living conditions of low-income homeowners who cannot afford necessary repairs or improvements.

Here’s a brief overview of what this program entails:

- It targets homeowners who are 62 years of age or older

- The funds can be used to repair, or upgrade their residence

- Grants can cover a variety of projects, such as fixing a leaky roof, installing energy-efficient appliances, or improving accessibility for disabled residents

In conclusion, the USDA offers specialized programs designed to meet specific needs in rural areas. From helping families purchase a new home, to providing financial assistance for essential repairs, these programs truly improve the quality of life for rural residents.

USDA Loans in Context

Comparing USDA Loans to Other Home Loans

USDA home loans offer a unique opportunity for homebuyers, particularly in rural areas. Established under the Housing Act of 1949, these loans have a few key differences compared to other popular financing options such as conventional, FHA, and VA loans.

- Down Payment: One of the most significant advantages of USDA loans is the 0% down payment requirement, compared to 3-20% for other home loans.

- Interest Rates: USDA loans typically have lower interest rates, providing a more affordable option for borrowers.

- Income Requirements: While other loans cater to various income levels, USDA loans are specifically targeted towards low- to moderate-income families.

- Property Eligibility: A critical aspect of USDA loans is that the property must be located in an eligible rural area, as defined by the U.S. Department of Agriculture.

| Loan Type | Down Payment | Interest Rates | Income Requirements | Property Eligibility |

|---|---|---|---|---|

| USDA Home Loan | 0% | Lower | Low- to moderate-income | Rural areas |

| Conventional | 3%-20% | Varies | Varies | No restrictions |

| FHA | 3.5% | Varies | Varies | No restrictions |

| VA (military) | 0% | Lower | Varies | No restrictions |

The Impact of COVID-19 on USDA Loans

The COVID-19 pandemic has had a significant impact on the housing market and mortgage industry. With its specific focus on supporting rural communities and low- to moderate-income families, USDA loans have been a crucial lifeline for many.

- Demand: With economic uncertainties and job losses, the demand for affordable mortgage options like USDA loans has increased. Many homebuyers have turned to these loans for their favorable terms and low interest rates.

- Processing Delays: Due to the increased demand and measures taken by lenders to protect their workforce, the processing time for USDA loans has lengthened. Borrowers should anticipate a longer wait time for approval and closing.

- Foreclosure Moratorium: The USDA Rural Development office has implemented temporary measures to protect homeowners with USDA loans. These include a moratorium on foreclosures and guidelines for mortgage forbearance and loan modifications.

In conclusion, USDA loans play a vital role in supporting rural communities and providing affordable housing options. By understanding the unique features and current challenges, borrowers can confidently navigate the USDA loan process.

Additional Resources

Navigating Government Assistance

When seeking technical assistance and resources for rural communities, it’s important to be aware of the various federal programs available. The USDA itself offers numerous programs to support rural development and growth. For instance, the Rural Development site provides a wealth of information on their programs, services, and application processes.

To compare different options and find the right program for you, consider using online tools and resources like Federal Program Inventory, which offers a comprehensive list of federal programs, along with descriptions and related details. Additionally, USA.gov serves as an all-encompassing portal to government assistance, making it easy to search for and navigate federal programs in various categories.

Educational Materials and Support

Beyond just the resources related to rural development, the USDA lends itself to a wide range of educational materials and support services that may be helpful when exploring USDA loans. For example, the USDA Farm Service Agency offers valuable information on programs targeting farmers and ranchers.

To further aid your understanding of USDA loans or to access technical assistance, the following resources can be of help:

- Webinars and Workshops: Keep an eye on the USDA Rural Development Events Calendar for upcoming webinars, workshops, and training sessions on various topics related to rural development and financing.

- Financial Resources: The National Agricultural Library features an impressive collection of USDA publications, funding opportunities, and research materials that can be instrumental in building your knowledge on USDA loans and agricultural finances.

- Guides and Toolkits: The USDA Rural Development site also offers various guides and toolkits catered to help with planning, financing, and managing rural development projects.

By utilizing these additional resources, you’ll be better equipped to navigate the complexities of USDA loans and government assistance programs.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.