Property Flipping Guide: Quick Tips for Maximum Profit

Property flipping has become an increasingly popular investment strategy in the world of real estate. The concept revolves around purchasing a property at a lower price and quickly renovating it to sell for a profit. Whether you’re a seasoned investor or a newcomer to the game, this guide is designed to help you navigate the property flipping landscape, ensuring you’re equipped with the necessary tools and knowledge to maximize your potential returns.

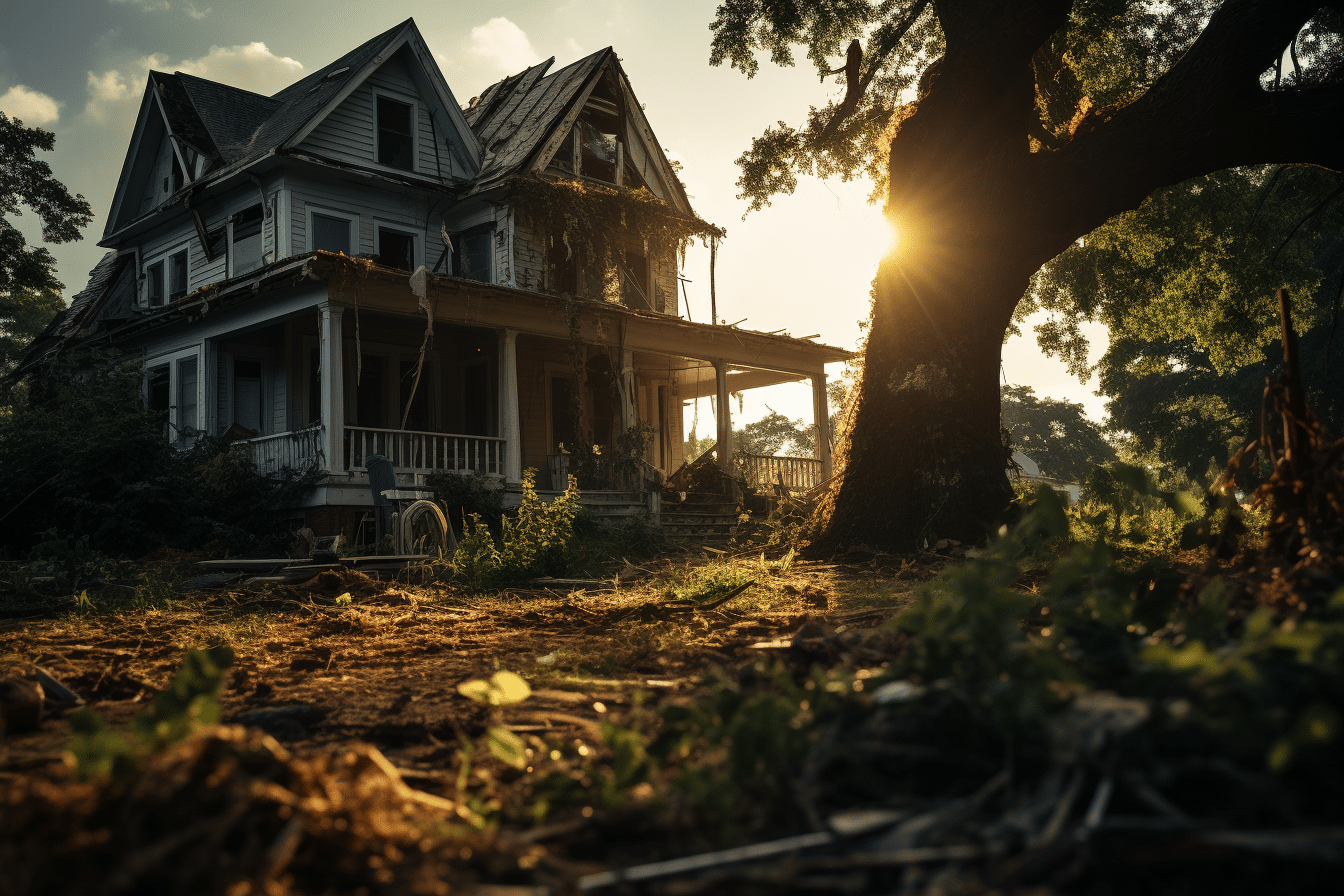

One of the critical elements of property flipping is finding the perfect property to transform. This process entails researching various neighborhoods and markets, seeking out undervalued or distressed properties with potential for significant improvement. Following this, developing a solid financial plan and strategy is essential for staying within your budget and ensuring you’re prepared for any complications that may arise.

Assembling a reliable team, including contractors, designers, and real estate agents, is another crucial factor in a successful flip. This roster of experts will assist in renovating and repairing your property while executing effective staging and marketing strategies. Navigating the final steps of closing the deal and employing risk management and mitigation techniques will safeguard your investment and ensure a successful, profitable outcome.

Key Takeaways from the Property Flipping Guide

- Research and select undervalued properties for transformation

- Develop a strong financial plan and assemble a reliable team

- Utilize effective staging, marketing, and risk management strategies

Finding the Right Property

Scouting Neighborhoods

Finding the right property to flip starts with scouting the right neighborhood. Look for locations with rising property values, good schools, and low crime rates. You can browse through online listings or attend open houses to get a better understanding of each neighborhood.

Do not forget to check out the available foreclosures and auctions, as they can often provide a good deal. Just make sure to do thorough research and be prepared for the potential risks associated with these types of properties.

Assessing Properties for Flip Potential

After narrowing down the neighborhood choices, the next step is to assess properties for their flip potential. Here are some factors to consider:

- Property Condition: Look for houses that need cosmetic updates rather than extensive repairs. Keep in mind that some properties may have hidden issues that can eat into your budget.

- House Layout: A sensible and functional layout is essential for a successful flip. Properties with odd layouts can be harder to sell.

- Price: Ensure the property is reasonably priced to allow for a profitable flip. Keep an eye on comparable sales in the area to determine the ideal purchase price.

Understanding the Market

An in-depth understanding of the local real estate market plays a crucial role in property flipping. Keep an eye on the trends in the area, such as average days on the market, sale prices, and buyer preferences.

- Local Market Trends: Familiarize yourself with market trends – are property values increasing or decreasing? This information can help you better estimate the potential profit.

- Know Your Target Audience: Identify the target demographic and cater to their preferences in your property flip. For example, families will value spacious layouts and proximity to schools.

In conclusion, finding the right property for flipping involves extensive research, scouting suitable neighborhoods, and understanding the local market. By considering these factors and avoiding common mistakes, you can potentially achieve a successful and profitable property flip.

Financial Planning and Strategy

Budgeting for Flipping

When it comes to property flipping, budgeting is essential for success. Establishing an accurate budget helps investors avoid costly mistakes and ensure an acceptable profit margin. The primary expenses to consider include purchase price, renovation costs, and holding costs. To streamline the process, it’s helpful to create a detailed spreadsheet, categorizing costs into separate sections such as labor, materials, and permit fees. Investors should also account for potential unforeseen expenses and add a buffer of around 10-20% on top of the estimated costs.

It’s crucial to remember the 70% rule when budgeting for flipping projects. This rule suggests that investors should not pay more than 70% of the after repair value (ARV) of a property, minus the repair costs. Adhering to this rule enables investors to maintain a healthy profit margin.

Exploring Financing Options

Aspiring property flippers should explore various financing options to optimize their investment strategy. Traditional loans, such as bank mortgages, may not always be the best choice due to stricter lending requirements and longer approval times. Therefore, alternatives like hard money loans, private lending, and cash-out refinances should be considered.

Hard money loans offer a quicker approval process and are granted based on the property’s value, rather than the borrower’s creditworthiness. While these loans come with higher interest rates and fees, their short-term nature and flexibility make them a popular choice for property flipping endeavors.

Evaluating Profit Margins and ROI

A property flipper’s ultimate goal is to achieve a high return on investment (ROI) through calculated financial strategies. Successfully evaluating profit margins involves estimating the ARV and deducting purchase, renovation, and holding costs. The resulting figure represents the potential profit to be had from the flip.

Investors must also assess ROI, which considers both the profit generated and the total investment amount. To calculate ROI, divide the net profit by the total investment, then multiply by 100 to obtain a percentage. A high ROI signifies a successful flip, but it’s crucial to weigh up the project risks and not merely focus on the potential returns.

Flippers should always conduct extensive due diligence on properties and the local market to make informed decisions and achieve desirable profit margins and ROI.

Building Your Team

Working with Real Estate Agents

When starting in property flipping, it’s essential to have a strong team to support your efforts. A crucial component of this team is a reliable real estate agent who can provide valuable insights and connections in the market. To find the right agent, consider the following:

- Experience: Seek professionals who have extensive experience in working with investors and property flippers.

- Local knowledge: Partner with agents who possess in-depth knowledge of the neighborhood or area you’re targeting.

- Communication: Make sure your agent is easily accessible and enjoys working with you.

Remember, a good real estate agent can make all the difference in your property flipping journey.

Choosing the Right Contractors

Another essential part of your team is a reliable contractor. Contractors can help you estimate costs, suggest necessary improvements, and complete the renovation work for your project. To choose the right contractor, consider these factors:

- Portfolio: Review their previous projects and check for positive online reviews to ensure they deliver quality work.

- Availability: Ensure they have the capacity to complete your project within the desired timeline.

- Licenses and Insurance: Verify they have the necessary licenses and insurance in place.

Lastly, when selecting your contractor, trust your instincts. Your relationship with your contractor should be comfortable and collaborative.

Furthermore, don’t forget to include other team members, like investors and trusted advisors, in your property flipping endeavors. They can provide guidance, knowledge, and funding to help ensure your projects are successful.

Remember, property flipping is a team effort, and building the right team is critical to your success. By working with skilled real estate agents and contractors, you can achieve your property flipping goals.

Renovation and Repairs

Design and Planning

Before starting any renovation or repairs, it’s essential to create a well-thought-out design plan. This will help visualize the outcome and ensure that all updates are cohesive throughout the property. Take time to research current trends, materials, and decide on a budget. Consulting with a professional designer or architect may be beneficial to avoid costly mistakes or overlooked details.

Dealing with Permits and Regulations

When engaging in property remodeling, permits and regulations are critical aspects to keep in mind. Many municipalities require permits for renovations, particularly for structural, electrical, or plumbing work. Familiarize yourself with local regulations and ensure all necessary permits are obtained before starting the project. It’s best to work with experienced contractors who are knowledgeable about the permitting process.

Executing the Upgrades

Once the design is finalized and permits obtained, it’s time to begin the renovation. Hiring reliable contractors is crucial at this stage, as their expertise will have a significant impact on the quality and timeline of the finished project. When deciding on contractors, consider factors such as:

- Experience in your specific type of project

- Positive reviews or references

- Proper licensing and insurance

When it comes to repairs, prioritize updates with the highest return on investment, such as updating kitchens, bathrooms or installing energy-efficient systems. For design inspiration, planning tips, or learning about the property flipping process in general, consider browsing online resources like this guide.

Throughout the renovation process, regularly inspect the work to ensure it aligns with the design plan and meets quality standards. Don’t hesitate to communicate any concerns with the contractor, as they can address them promptly. Property flipping can be a rewarding endeavor if proper planning, investment, and execution are in place.

Staging and Marketing

Home Staging Techniques

Staging a property is crucial in making a great first impression for potential buyers. It involves arranging furniture and accessories to highlight a home’s best features, making it appealing and inviting.

- Curb appeal: Start with improving the home’s exterior, as it is the first thing buyers will notice. Simple steps like cleaning the driveway, trimming hedges, and adding potted plants can make a difference.

- Landscaping: Create an attractive outdoor space that captures the attention of passersby. Mow the lawn, trim the trees, and add colorful flowers to enhance the overall look.

- Furniture arrangement: Consider the flow of the rooms and ensure furniture is arranged to maximize the space. Remove any unnecessary items or clutter to make the space feel more open and airy.

- Lighting: Make sure to have attractive and functional lighting. Open up the blinds and curtains, and use lamps to create a warm, welcoming atmosphere.

- Accessorizing: Add tasteful accents and decor to showcase the home’s personality. Stick to neutral colors and designs to appeal to a wide range of buyers.

Effective Marketing Strategies

Marketing a flipped property can make or break the sale. Here are some tips to ensure the property gets maximum exposure:

- Professional photography: Invest in hiring a professional photographer to take high-quality photos of your property. This will make a lasting first impression and showcase the property’s best features.

- Virtual tours: Create a virtual tour of the property that allows buyers to explore the home online. This can be a valuable tool for marketing, especially during times when in-person showings are limited.

- Social media: Utilize social media platforms like Facebook, Instagram, and Pinterest. Share your property photos, virtual tour, and any relevant details to generate interest and reach a broader audience.

- Listing websites: List your property on popular websites like Zillow, Trulia, and Realtor.com. Ensure the listing description highlights the home’s best features and improvements made during the flip.

- Open houses: Host a well-planned open house to invite potential buyers to see the property in person. Make sure to promote the event on social media and other marketing platforms.

By using these home staging techniques and effective marketing strategies, you can showcase the property in its best light and increase the chances of a successful flip.

Closing the Deal

Negotiation with Buyers

When it comes to property flipping, negotiating with buyers is essential. Never make exaggerated or false claims about the house; honesty and transparency are crucial to build trust. It’s important to emphasize the home’s strengths while conveying the value of any improvements that were made.

To make the property more attractive and profitable:

- Offer incentives like paying closing costs

- Be flexible with negotiations

- Allow staging for a faster sale

Make sure not to let emotions get in the way and be willing to compromise.

Understanding Taxes and Fees

In property flipping, you need to understand the taxes and fees involved before closing the deal. These include but are not limited to:

- Transfer taxes

- Property taxes (prorated)

- Closing costs

- Agent commissions

While these costs might feel daunting, it’s essential to factor them into your final calculations. Keep an eye on the TINS (Transfer Information Notification System) for any new taxes or changes in the fees.

Finalizing the Sale

As you work towards finalizing the sale, there are some steps to complete:

- Request and review the property’s title report

- Schedule a closing date with the buyer

- Review the closing documents (purchase agreement, title insurance, escrow instructions)

Ensure all agreements are in writing, and everything has been reviewed and legally approved before signing. It’s important to follow all required regulations, and involve a real estate lawyer if necessary to avoid potential complications.

By understanding the concepts of negotiation with buyers, being aware of taxes and fees, and completing all necessary steps to finalize the sale, you’re well on your way to successfully flipping properties.

Risk Management and Mitigation

When it comes to property flipping, it’s essential to be prepared for potential risks and have a plan in place to mitigate them. In this section, we’ll discuss two key areas: Insurance Considerations and Contingency Planning.

Insurance Considerations

Insurance plays a critical role in protecting your investment throughout the flipping process. It’s important to consider the different types of coverage that may be applicable:

Property Insurance: Protects against damages to the property such as fire, theft, and vandalism. Ensure that your coverage is adequate for the property’s value and the extent of the renovations.

Liability Insurance: Covers injury or damage claims made by third parties, for example, if a contractor gets injured on-site.

Builder’s Risk Insurance: Offers protection during the construction/renovation phase, particularly for risks like theft, vandalism, and weather-related damage.

Keep in mind that as you make changes to the property, you may need to adjust your insurance coverage accordingly.

Contingency Planning

Unexpected issues can arise during the flipping process, and having a well-thought-out plan can minimize the impact on your financial risk. Here are some things to consider:

Develop a financial cushion: Set aside extra funds to cover any unforeseen expenses, such as:

- Additional repair costs

- Holding costs (e.g., property taxes, utilities) if the property sale takes longer than expected

Thorough property inspection: Before purchasing, have a detailed inspection done to identify any potential issues that could impact your renovation budget.

Get multiple quotes: When hiring contractors and purchasing materials, get multiple quotes to ensure you’re getting the best prices and avoid potential budget overruns.

Establish relationships with professionals: Building connections with contractors, inspectors, and insurance agents can save time and money and keep your project on track.

In conclusion, property flipping involves various risks that you can manage and mitigate by having comprehensive insurance coverage and effective contingency planning. This approach will help ensure a smoother flipping process and reduce the chances of unexpected setbacks impacting your profitability.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.