Real Estate Pricing Strategies

Have you ever found yourself lost in the labyrinth of real estate pricing? You’re not alone. Many people find themselves in the same situation when they decide to sell their property. The question of “How much should I list my property for?” is common. But worry not because we’re here to help you navigate through the maze of real estate pricing strategies.

Understanding the Market

The real estate market is a dynamic entity that changes with time. Understanding the current state of the market is the first step in formulating your pricing strategy.

The Importance of Market Analysis

Market analysis is a crucial element in understanding the real estate market. It involves studying the prices at which similar properties in your area have been sold recently. This gives you a ballpark figure of how much buyers are willing to pay for a property like yours.

Factors Influencing the Market

Several factors influence the real estate market. These include the economy, interest rates, and the supply and demand of properties. Understanding these factors can help you predict future market trends and price your property accordingly.

Setting the Right Price

Setting the right price for your property is a delicate balance. Price it too high, and you risk scaring off potential buyers. Price it too low, and you might not get the profit you deserve.

Pricing Below Market Value

One strategy is to price your property slightly below market value. This can attract more buyers and potentially spark a bidding war, driving the price up. However, this strategy should be used with caution, as it could also lead to a lower final sale price if a bidding war doesn’t ensue.

Pricing at Market Value

Pricing your property at market value is often seen as the safest option. This involves setting a price that reflects the current market rate based on your market analysis. This strategy is straightforward and gives buyers confidence that they’re getting a fair deal.

Pricing Above Market Value

Pricing your property above market value is a riskier strategy but can pay off in certain situations. If your property has unique features that buyers highly value, or if there’s a shortage of similar properties on the market, you might be able to get away with a higher price. However, your property could languish on the market if the price is too high.

Using Comparative Market Analysis (CMA)

Comparative Market Analysis (CMA) is a tool used by real estate professionals to determine the value of a property. It involves comparing your property to similar properties that have recently been sold in your area. The comparison takes into account factors such as location, size, condition, and features.

| Property Details | Your Property | Comparable Property 1 | Comparable Property 2 | Comparable Property 3 |

|---|---|---|---|---|

| No. of Bedrooms | 3 | 3 | 3 | 4 |

| Square Footage | 2000 | 2100 | 1950 | 2200 |

| Sale Price | – | $250,000 | $240,000 | $275,000 |

Gathering Information

The first step in conducting a CMA is to gather information about your property. This includes details such as the number of bedrooms and bathrooms, the square footage, the year it was built, and any recent renovations.

Evaluating Comparable Properties

Next, you’ll need to find comparable properties, or “comps,” that have recently been sold in your area. These comps should be as similar as possible to your property in terms of size, location, and features.

Making Adjustments

Once you’ve found your comps, you’ll need to make adjustments to account for any differences between your property and the comps. For example, if your property has a renovated kitchen and the comps do not, you might add value to your property’s estimated price.

The Psychology of Real Estate Pricing Strategies

The psychology of pricing plays a significant role in real estate. It’s not just about the numbers but about how they are perceived. Let’s delve into some psychological pricing strategies that can influence a buyer’s decision.

| Pricing Strategy | Description | Effect |

|---|---|---|

| Power of Four and Seven | Pricing a property at $247,000 instead of $250,000 | Prices ending in lower digits appear as better discounts |

| $19.99 Syndrome | Pricing a property at $199,999 instead of $200,000 | The price seems lower than it actually is |

| Writing the Price Without Commas | Writing the price as $1400000 instead of $1,400,000 | The price seems lower to the buyer |

The Power of Four and Seven

The numbers four and seven have a unique power in pricing. For instance, pricing a property at $247,000 instead of $250,000 can make the price seem significantly lower to a buyer. This is known as the “Right Side Digit Effect,” where prices ending in lower digits appear as better discounts.

The $19.99 Syndrome

This is a common pricing strategy used in retail and can also be applied to real estate. Instead of pricing a property at a round number, you price it slightly lower. So instead of listing a property for $200,000, you might list it for $199,999. This strategy can make the price seem lower than it actually is.

Writing the Price Without Commas

Another psychological trick is to write out the price without commas. For example, a price of $1,400,000 might be written as $1400000. This can make the price seem lower to the buyer.

Online Listings and Their Impact

In today’s digital age, most buyers start their property search online. Therefore, your online listing plays a crucial role in attracting potential buyers.

The Importance of Online Listings

Online listings are often the first point of contact between a buyer and your property. A well-crafted online listing can attract more buyers and increase the chances of a sale.

The Impact of Photos

High-quality photos are a must for any online listing. They give potential buyers a visual understanding of the property and can significantly influence their decision to view the property in person.

The Role of Descriptions

The description in your online listing is your chance to highlight the unique features of your property and sell its benefits to potential buyers. A compelling description can pique a buyer’s interest and prompt them to learn more.

Aspirational Pricing

Aspirational pricing is a strategy used for luxury or unique properties. It involves setting a price higher than the current market value to create a sense of exclusivity and scarcity. This strategy can effectively attract high-end buyers willing to pay a premium for unique properties.

When to Use Aspirational Pricing

Aspirational pricing is best used when you’re selling a luxury property or a property with unique features that are highly sought after in the market. It’s also effective in a seller’s market, where demand and supply are low.

The Risks of Aspirational Pricing

While aspirational pricing can lead to higher profits, it also comes with risks. If the price is set too high, it can deter potential buyers and cause the property to sit on the market for a long time. Therefore, using this strategy wisely and adjusting the price if necessary is essential.

Stay tuned for the final part of our comprehensive guide to real estate pricing strategies. We’ll discuss more advanced strategies and provide tips on navigating the complex world of real estate pricing. Whether you’re a seasoned professional or a first-time seller, there’s something for everyone in our guide.

Advanced Pricing Strategies

In the world of real estate, there are several advanced pricing strategies that can be employed to maximize profits and attract the right buyers.

| Pricing Strategy | Description | When to Use |

|---|---|---|

| Value Range Pricing | Setting a price range instead of a fixed price | To attract a wider range of buyers and potentially spark a bidding war |

| Absorption Pricing | Pricing your property lower than the competition | When there’s a high inventory of properties on the market |

| Bait Pricing | Pricing your property significantly lower than its market value | To attract a large number of buyers and then increase the price |

Value Range Pricing

Value range pricing is a strategy where you set a price range instead of setting a fixed price. This strategy can attract a wider range of buyers and can also spark a bidding war, leading to a higher final sale price.

Absorption Pricing

Absorption pricing is a strategy used when there’s a high inventory of properties on the market. It involves pricing your property lower than the competition to ensure it gets sold quickly.

Bait Pricing

Bait pricing is a strategy where you price your property significantly lower than its market value to attract a large number of buyers. Once the buyers are interested, you can then increase the price.

The Bottom Line

Navigating the world of real estate pricing strategies can be complex, but with the right knowledge and tools, you can set a price that attracts buyers and maximizes your profits. Whether you’re using a Comparative Market Analysis, understanding the psychology of pricing, or employing advanced pricing strategies, the key is to understand your market and set a price that reflects the value of your property.

Remember, the right pricing strategy can significantly affect how quickly your property sells and how much profit you make. So take the time to understand these strategies and choose the one that works best for your situation. As always, please contact us if you have any questions about pricing your home.

FAQs

What are the three pricing strategies for real estate?

The three main pricing strategies for real estate are pricing below market value, pricing at market value, and pricing above market value. Each strategy has its own advantages and disadvantages and should be chosen based on the current state of the market and the specifics of your property.

What are the four pricing strategies?

The four main pricing strategies are value range pricing, absorption pricing, bait pricing, and aspirational pricing. These more advanced strategies can be used to maximize profits and attract the right buyers.

What is the most successful pricing strategy?

The most successful pricing strategy depends on your property’s specifics and the market’s current state. However, pricing at market value is often seen as the safest and most reliable strategy.

What are the 2 basic approaches to set list prices?

The two basic approaches to setting list prices are using a Comparative Market Analysis (CMA) and understanding the psychology of pricing. A CMA involves comparing your property to similar properties that have recently been sold while understanding the psychology of pricing involves using specific pricing techniques to influence buyers’ perceptions of the price.

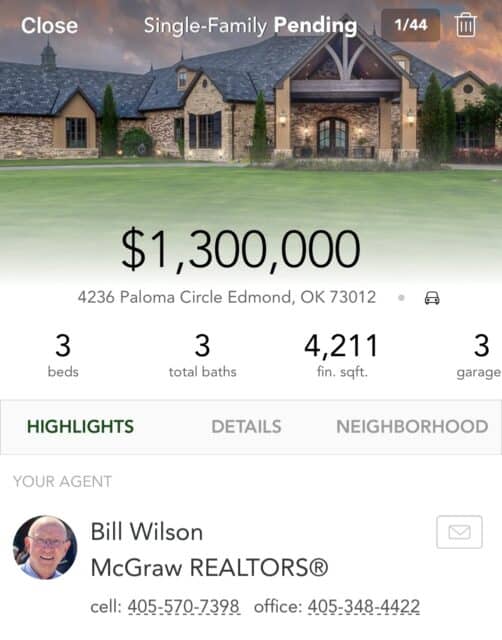

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.