Oklahoma City Real Estate Blog

Finance

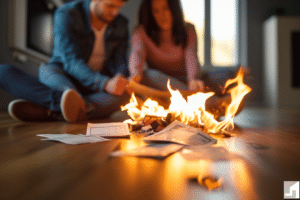

Should You Pay Off Your Mortgage Early? Weighing the Pros and Cons

Paying off your mortgage can be viewed as both a financial and personal milestone for many homeowners. It’s a critical decision that many face, leading…

Mortgage Tips for High-Income Individuals

Navigating the mortgage landscape as a high-income individual can be complex and require unique strategies for maximizing benefits and minimizing financial risks. With higher earning…

Saving for a Mortgage Down Payment: Simple Tips for Future Homeowners

Buying a home is an exciting milestone in life, but it also comes with significant financial responsibility. Saving for a down payment is often one…

Understanding Mortgage Rates: A Quick and Easy Guide

Understanding mortgage rates can be an overwhelming process for homebuyers. Mortgage rates are a crucial factor for potential homeowners as it determines not only their…

Understanding Mortgage Payments: A Quick and Easy Guide

Understanding mortgage payments is crucial for anyone looking to buy a home or currently paying off their mortgage. Mortgage payments are the monthly installments paid…

Understanding Mortgage Refinancing: A No-Nonsense Guide for Home Loan Makeovers

Mortgage refinancing can be a bit of a head-scratcher to wrap your mind around, but fear not, this article is here to guide you through…

Difference Between Pre-approval and Pre-qualification

If you’re considering buying a home, you’ve likely heard the terms pre-approval and pre-qualification. While both play a role in the home-buying process, they serve…

Mortgage Underwriting Process: An Essential Overview

Navigating the world of home buying can be challenging, whether you’re a first-time buyer or a seasoned homeowner. One of the most critical aspects of…

Choosing a Mortgage Lender: Quick Tips

Choosing a mortgage lender can be an overwhelming process for many potential homeowners. As one of the most significant financial decisions you’ll make in your…

Improving Credit for Mortgage Approval: Quick and Simple Steps

Improving your credit score is essential when seeking mortgage approval, as this is one of the key factors lenders consider when determining your eligibility for…

Understanding Mortgage Pre-Qualification

Embarking on the journey to homeownership can be both exciting and overwhelming. One of the initial steps many homebuyers take to prepare themselves financially is…

VA Loans Uncovered: The Quick Guide to Homeownership

VA loans are a unique and valuable financial resource available to veterans and service members. This type of mortgage, which is backed by the U.S.…