Should You Pay Off Your Mortgage Early? Weighing the Pros and Cons

Paying off your mortgage can be viewed as both a financial and personal milestone for many homeowners. It’s a critical decision that many face, leading to the age-old question: should you pay off your mortgage or continue making monthly payments? Let’s dive into the various factors that can influence this decision.

To make an informed decision, it’s essential to weigh the pros and cons, as each individual’s financial situation is unique. Some homeowners might prioritize becoming debt-free, while others may focus on optimizing their tax deductions and investments. Another factor to consider is the interest rate on your mortgage, which can have a significant impact on your monthly payment.

Ultimately, the decision to pay off your mortgage comes down to your personal financial goals and circumstances. By examining the benefits and drawbacks, understanding the possible tax implications, and considering alternative investment options, you can make the most suitable choice for your financial future.

Key Takeaways

- Assessing your individual financial situation is crucial in deciding whether to pay off your mortgage

- Considering the mortgage’s interest rate and tax implications can influence your decision

- Weighing investment opportunities against mortgage payoff can help determine the right choice for your financial goals

On a Personal Note…

On a personal note, I’d like to share a milestone from my own journey that might offer some perspective. Several years ago, we made the decision to pay off our mortgage early. It was a decision that took considerable thought and planning, but ultimately, it was one that brought a sense of liberation and accomplishment.

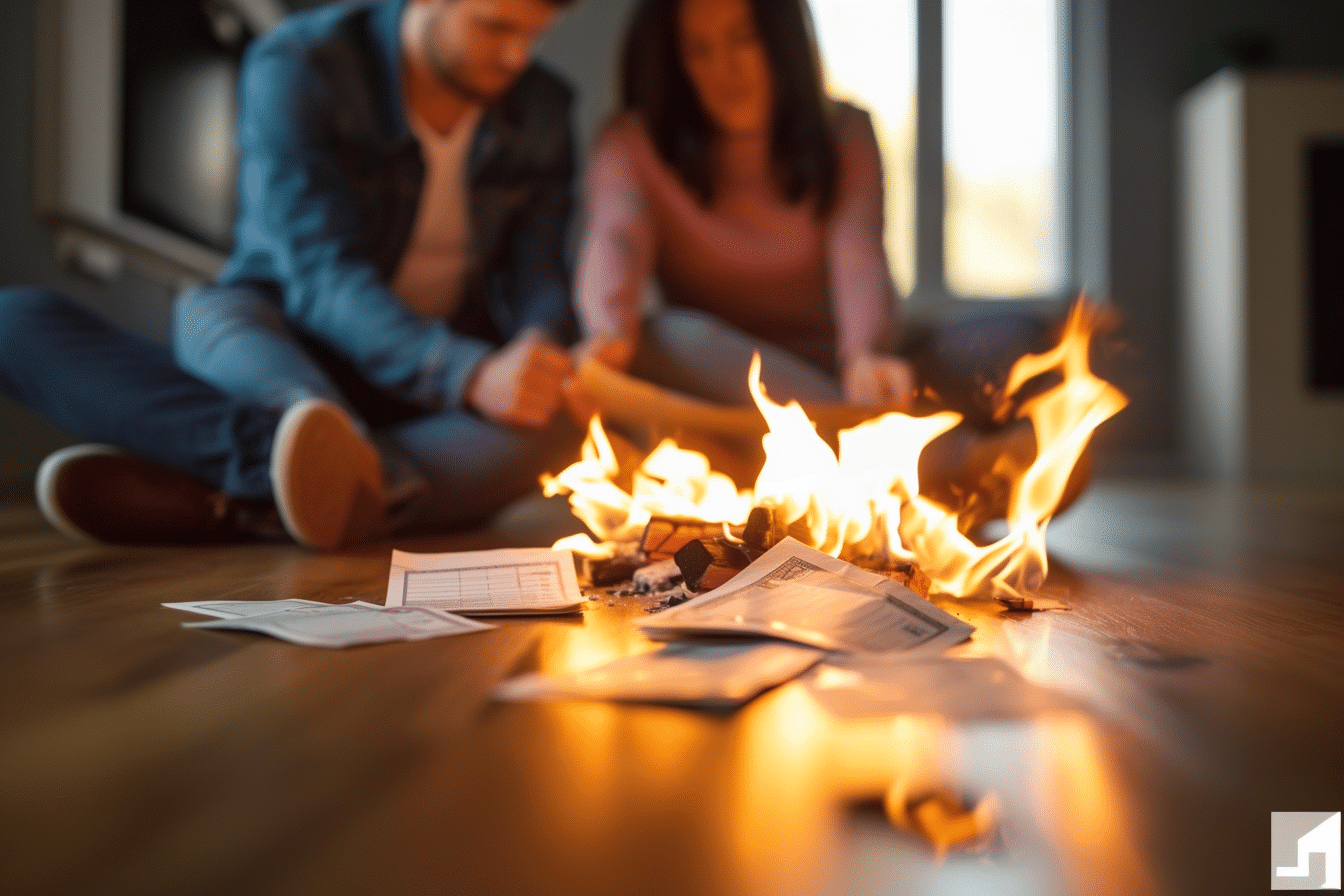

I remember vividly the day when we gathered as a family around the dinner table, the mortgage papers in hand. As we set fire to them and watched the flames consume the tangible symbol of our debt, the room was shocked! Our kids, eyes wide, watched as the last remnant of our mortgage turned to ash. It was a powerful moment that underscored the significance of being free from the weight of that financial obligation.

However, I must caution that the end of mortgage payments doesn’t mean the end of expenses related to home ownership. Property taxes, homeowner insurance, and HOA fees linger on, and these can be substantial. It’s essential to keep these in mind and to plan accordingly.

Yet, despite these ongoing costs, there is something incredibly satisfying about knowing your home is truly yours, free and clear of any debt. The peace of mind that comes from knowing that the roof over your head is paid in full is, in my experience, unparalleled.

So, should you pay off your mortgage early? The answer isn’t always straightforward and depends on your personal circumstances. But for us, that decision was a step towards financial freedom, and it’s a decision we’ve never regretted.

Should You Pay Off Your Mortgage Early: The Pros and Cons

Benefits of Paying Off Your Mortgage

Paying off a mortgage definitely has its benefits. One of the key advantages of paying off a mortgage is long-term interest savings. Homeowners can potentially save thousands in interest by fully repaying their mortgage.

Another important consideration is cash flow. Without a mortgage payment, homeowners have more money available each month. This frees up their budget for other necessities or for boosting their savings and investment opportunities.

In addition, homeowners gain increased home equity by paying off their mortgage. As a result, they’ll have additional borrowing power available if needed. The financial freedom gained from paying off a mortgage can also lead to greater peace of mind for homeowners.

Potential Drawbacks

Nonetheless, prepaying a mortgage also comes with some risks. One potential consequence is reduced liquidity. Allocating a significant portion of one’s funds toward paying off a mortgage may leave homeowners with limited savings and even impact their emergency fund. This could be a problem in case of unforeseen expenses or even a sudden job loss.

Furthermore, homeowners may be better off investing their money elsewhere, rather than focusing only on paying off their mortgage. For example, investing in a high-yield income property or paying off high-interest debt before tackling a mortgage could provide greater returns over time.

Lastly, one of the benefits of having a mortgage is the potential for receiving a tax deduction on the interest paid if eligible. However, paying off a mortgage would invalidate that deduction, which could result in homeowners owing more in taxes each year.

In summary, when considering if one should pay off their mortgage, it is crucial to weigh the potential benefits and risks involved. Some homeowners may find that prioritizing their emergency fund, other high-interest debt, or investment opportunities proves to be a more effective strategy.

Understanding Mortgage and Tax Implications

How Mortgages Work

A mortgage is a loan that helps individuals or businesses purchase a property. The borrower agrees to repay the principal (the amount borrowed) plus interest over a specified period, usually 30 years. Mortgages have two main components: principal and interest. The amortization schedule determines how much of each monthly mortgage payment goes towards the principal and how much goes towards the interest.

Mortgage rates play a crucial role in determining the overall cost of a mortgage. Lower rates mean lower monthly payments, while higher rates result in higher monthly payments. Borrowers can refinance their mortgage, which may lower their interest rate and potentially reduce the loan’s overall cost.

Tax Considerations

One of the advantages of having a mortgage is the mortgage interest tax deduction. This deduction allows homeowners to reduce their taxable income by the amount of interest paid on their mortgage. However, the tax laws surrounding this deduction have changed recently, and it is essential to understand what is still deductible.

The Federal mortgage interest tax deduction works as follows:

- Taxpayers can deduct the interest paid on their primary residence and in some cases, a second home.

- Mortgage interest is deductible on acquisition indebtedness (used to buy, build, or improve a home) of up to $750,000 for those filing taxes jointly or $375,000 for individuals.

- Interest paid on home equity lines of credit (HELOCs) or home equity loans can also qualify for the deduction, but only if used to buy, build, or improve the home that secures the loan.

It’s worth noting that the new tax laws have increased the standard deduction for taxpayers, often making it more advantageous to take the standard deduction instead of itemizing deductions, including the mortgage interest tax deduction. This can make the tax benefit of a mortgage less significant for some homeowners.

In conclusion, when considering whether to pay off a mortgage early, it’s essential to understand how mortgages work, the potential tax implications, and weigh the benefits of refinancing or other financial strategies against the costs.

Investing Versus Paying Off Your Mortgage

When it comes to deciding whether to focus on paying off your mortgage or investing your extra cash, it’s essential to weigh the potential returns and risks of each option. This section will explore the nuances of investing versus paying off your mortgage, with a focus on comparing investment returns and maximizing retirement accounts.

Comparing Investment Returns

Historically, investing in the stock market has provided higher average returns than paying off a mortgage early. However, this varies depending on the current stock market conditions, interest rates, and other economic factors. For example, if mortgage interest rates are low and the stock market is performing well, investing might provide a higher return on investment.

A common approach to investing is through mutual funds, which spread risk across a diverse portfolio. Financial advisors can help navigate the world of investing in mutual funds, providing personalized advice based on individual financial situations and goals.

Let’s compare the average returns of mortgage repayment and investing in the stock market using expected rates.

| Mortgage Repayment | Stock Market Investment | |

|---|---|---|

| Average Return | 4% | 7% |

As shown in the table above, average returns from stock market investments can be higher than mortgage repayment returns. However, it’s essential to understand that investments come with risks and unpredictable market fluctuations.

Maximizing Retirement Accounts

One smart approach to investing is focusing on retirement savings. Utilizing tax-advantaged retirement accounts such as 401(k) and IRA plans can help maximize your investment returns while providing long-term financial security.

Many employers offer a 401(k) plan with an employer match – a percentage of your contributions that the company adds to your account, essentially free money. It is generally recommended to contribute at least enough to secure the full employer match, then consider other investment strategies or paying down the mortgage.

IRAs, either traditional or Roth, are another popular tax-advantaged retirement savings option. With traditional IRAs, contributions are tax-deductible, and the investment grows tax-deferred. Roth IRAs, on the other hand, are funded with after-tax dollars, but withdrawals in retirement are tax-free.

When considering whether to pay off your mortgage or invest in retirement accounts, it’s crucial to consider the tax benefits, employer match, and potential growth that these accounts offer.

Ultimately, the decision to pay off a mortgage or invest in the stock market and retirement savings comes down to individual goals, risk tolerance, and financial circumstances. A balanced approach that addresses both mortgage repayment and investing might be the best option for many homeowners.

Strategies for Mortgage Payoff

When considering paying off your mortgage, it’s essential to explore different strategies that can help you achieve this goal effectively. This section will discuss two popular approaches: Making Extra or Biweekly Payments and Refinancing for Better Terms.

Making Extra or Biweekly Payments

One effective strategy for paying off your mortgage early is to make extra payments or switch to a biweekly mortgage payment plan. By paying more than the required amount or making payments every two weeks, you can reduce your principal balance faster, thus shortening your loan term.

Extra Payments: Allocating additional funds towards your mortgage payment each month goes directly towards the principal, ultimately reducing the amount of interest you’ll pay over the life of the loan.

Biweekly Mortgage Payments: Instead of paying your mortgage once a month, you can choose to pay half the amount every two weeks. This results in 26 half-payments per year, essentially equaling 13 full payments. This extra payment can help you reduce the principal significantly, shortening your loan term.

It’s important to note some mortgage lenders might enforce a prepayment penalty for making extra payments or switching to a biweekly payment plan, so always check with your lender beforehand.

Refinancing for Better Terms

Another method to potentially pay off your mortgage faster is refinancing. This entails replacing your current mortgage with a new one, typically at a lower interest rate or with a shorter loan term. Refinancing can help by:

- Lowering Interest Rates: If you can secure a lower interest rate on your mortgage, you’ll save money on interest payments and can allocate more towards the principal, leading to faster payoff.

- Shorter Loan Term: Opting for a shorter loan term means making higher payments, but these payments contribute more towards the principal and less towards interest, allowing you to build home equity faster.

While refinancing can be a suitable path to mortgage payoff, it’s important to weigh the pros and cons. You might face additional costs, such as closing and appraisal fees, as well as potential prepayment penalties. Make sure to consult with your mortgage lender and analyze the differences between your current loan and potential new loan before making a decision.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.