Why So Many Homeowners Are Mortgage-Free (and Why That Matters to You)

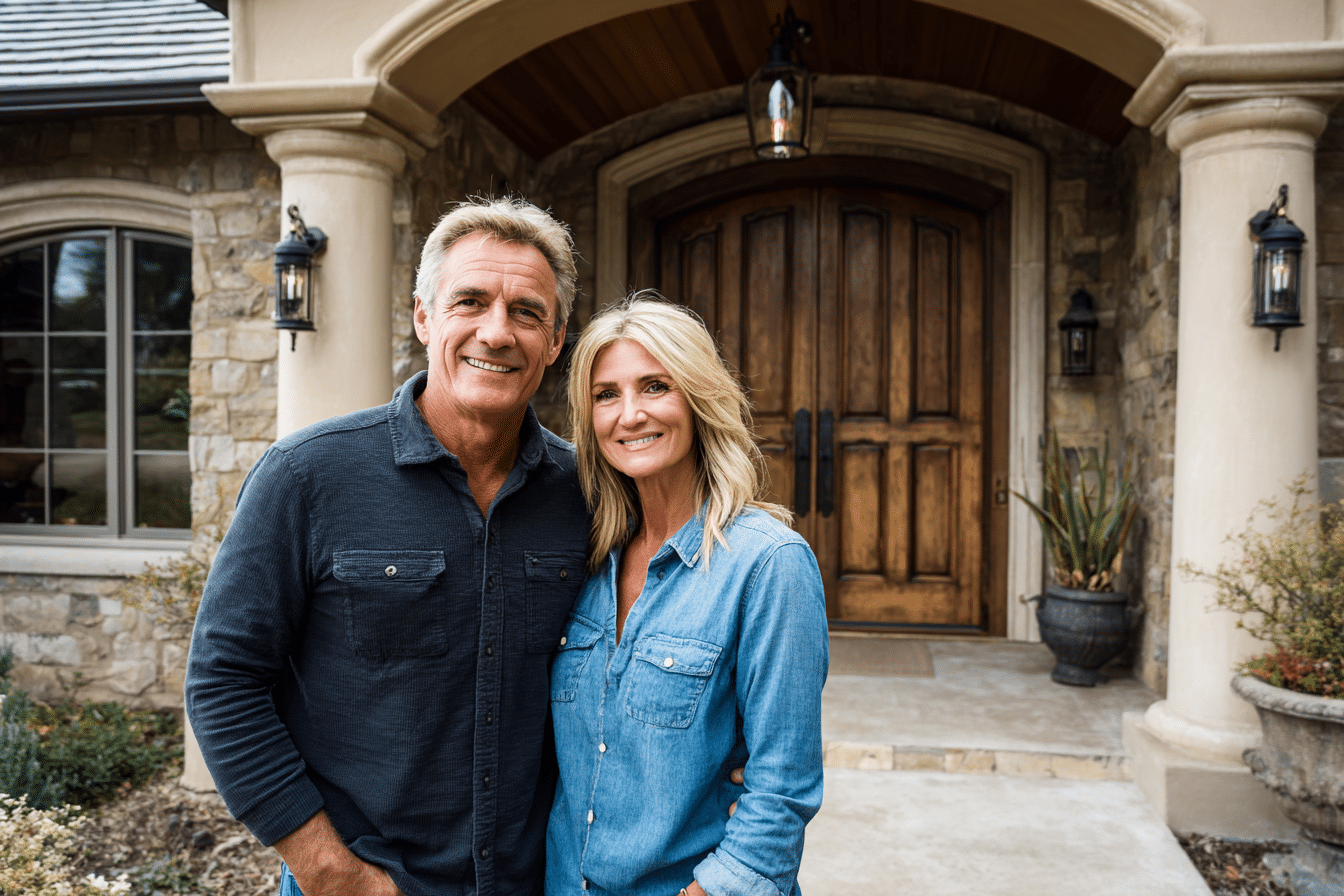

In 2017, after years of making payments, we finally paid off our home.

To mark the moment, we invited all the kids and grandkids over to the house. They didn’t know why they were there. Once everyone was gathered in the kitchen, I pulled out our mortgage paperwork and did something they definitely weren’t expecting—I burned it right there in front of them.

I still remember the looks on their faces. A mix of surprise, confusion, and curiosity.

I told them, “This is what you’re working toward.”

Not just paying off a house—but building stability, freedom, and options over time. I hope that moment left a lasting impression on them, because it perfectly captures what homeownership can quietly become if you stay the course.

That experience comes to mind often when I look at today’s numbers. National data now shows that 40.3% of U.S. homeowners own their homes mortgage-free, and many more are sitting on far more equity than they realize. It’s a reminder that wealth in real estate usually isn’t flashy or fast—it’s built steadily, year by year, in the background.

And whether your mortgage is paid off or you’re still making payments, understanding your equity is one of the smartest ways to understand where you truly stand today.

Home Equity, Explained Simply

At its core, home equity is straightforward:

It’s the difference between what your home could sell for today and what you still owe on your loan.

For example:

- Home value: $600,000

- Mortgage balance: $200,000

- Equity: $400,000

What’s important is how that equity builds.

It doesn’t usually come from one big jump. It grows steadily over time as:

- Home values rise

- Loan balances shrink with each payment

- Refinancing into lower rates accelerates payoff

That’s why longtime homeowners—especially those who bought years ago—often underestimate what they’ve accumulated. The growth happens quietly in the background.

Why Mortgage-Free Ownership Is Increasing

The rise in mortgage-free homeowners didn’t happen overnight. It’s been building for years.

Here’s what the data shows:

- 40.3% of U.S. homeowners now own their homes free and clear

- Up from 39.8% just one year ago

- Up from 32.8% in 2010

The biggest factor? Time.

Many homeowners who purchased 20–30 years ago have either paid off their loans completely or are very close. As people stay in their homes longer, full payoff naturally becomes more common.

Among homeowners 65 and older, nearly two-thirds now own outright. That shift alone has a major impact on overall housing trends.

How This Changes the Market

When a large share of homeowners don’t carry mortgage debt, the market behaves differently.

You see:

- Fewer forced sales

- More pricing patience

- Less volatility overall

For homeowners, this creates something even more valuable than market stability: choice.

Equity provides flexibility. It allows decisions to be made thoughtfully—not out of pressure or urgency.

What Homeowners Commonly Do With Their Equity

Once people understand how much equity they’ve built, many start exploring possibilities. Selling is just one option—and often not the first.

Some common paths include:

- Downsizing to simplify and free up cash

- Buying another property while keeping the current home

- Renovating instead of relocating

- Making aging-in-place or accessibility upgrades

- Helping family with housing or major expenses

- Staying put with peace of mind and financial security

Others use equity as a planning tool, not an action step. That might mean:

- Getting a clear equity snapshot

- Exploring HELOC or home-equity loan options

- Reviewing long-term financial or tax implications with professionals

The takeaway? Equity doesn’t end the conversation—it expands it.

Why Many Homeowners Undervalue Their Equity

Despite national trends, many homeowners still underestimate their position.

Common reasons:

- They haven’t updated their home’s value recently

- They still think in terms of their original purchase price

- They assume market changes don’t affect their neighborhood

But local shifts can quietly change values far more than people expect. Without current, neighborhood-specific data, it’s easy to miss the full picture.

A Simple Next Step (No Pressure)

You don’t need to be planning a move to understand your equity.

Knowing where you stand:

- Helps with long-term planning

- Removes guesswork

- Gives you options before you need them

If you’re curious about your home’s current value and what your equity really looks like using local data, I’m happy to walk through it with you.

Sometimes the smartest move isn’t making one—it’s simply knowing what you already have.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.