Where the 2025 Housing Market Is Headed (And What It Means for You)

Mid-Year Housing Market Update: What’s Ahead for the Rest of 2025?

Can you believe we’re already halfway through 2025?

As we look toward the second half of the year, one question keeps coming up from both buyers and sellers: What’s next for the housing market?

While there’s no crystal ball, updated forecasts from housing economists at Fannie Mae, Zillow, NAR, MBA, and others give us a solid picture of where things may be headed—from home prices and mortgage rates to sales activity and inventory levels.

We’ve rounded up the latest national outlooks, and more importantly, added our local insights on what’s happening right here in the Oklahoma City metro.

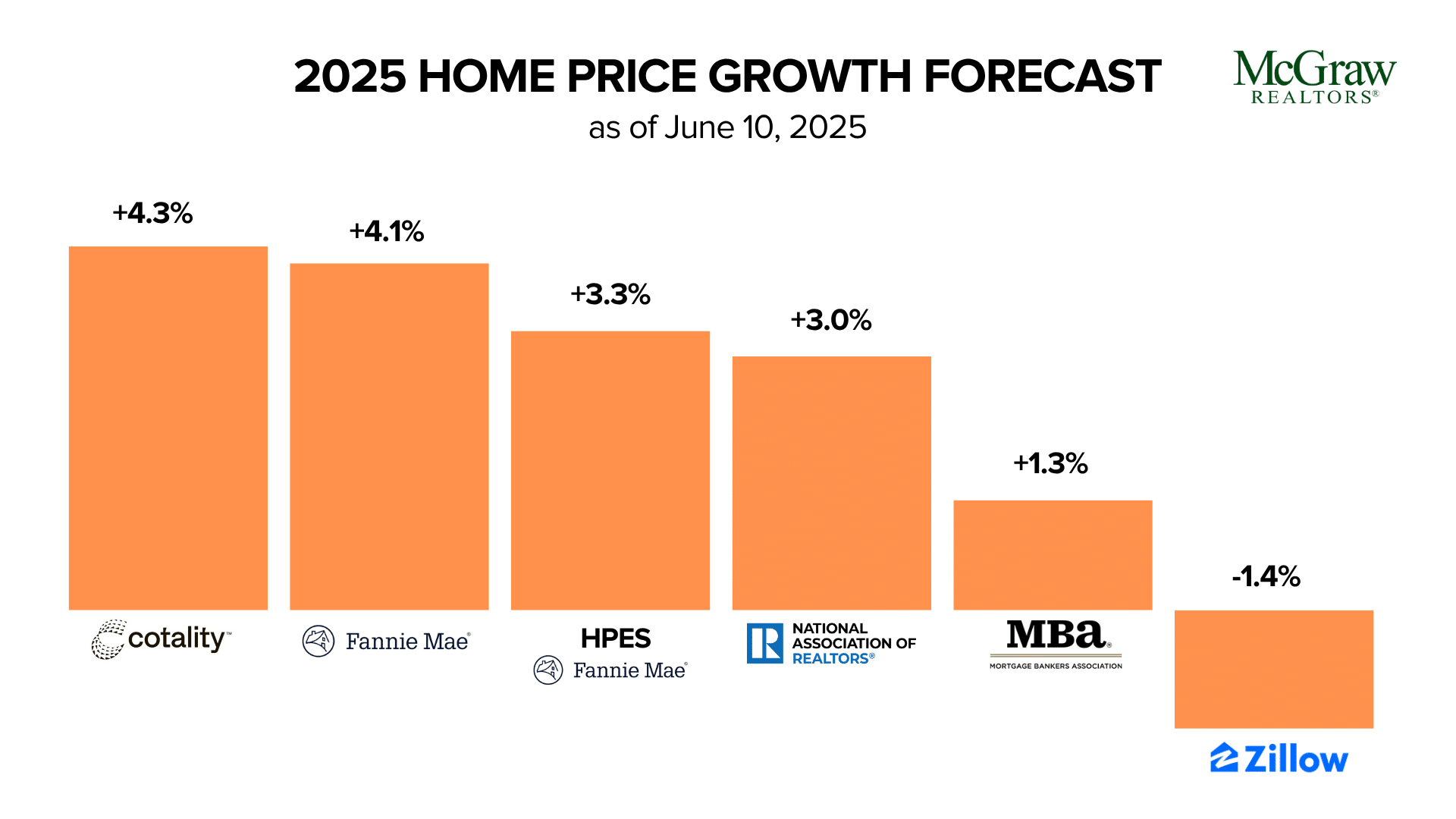

Home Prices: Slower, Steady Growth

Across the board, most economists agree: home prices will keep rising, just at a slower pace than the last few years. Here’s what the major players are predicting for 2025:

- Cotality: +4.3% (April 2025–April 2026)

- Fannie Mae: +4.1%

- NAR: +3% this year, +4% in 2026

- MBA: +1.3%

- HPES: +3.3%

- Zillow: -1.4% (an improvement from their previous -1.9%)

Some overheated markets—like parts of Florida, Texas, and Washington, D.C.—are seeing small declines, while more affordable areas in the Midwest and Northeast are staying strong.

Here in the OKC Metro, we’re seeing a similar trend: home prices are projected to rise 2.5% to 3% through the end of the year. It’s steady, but definitely slower than in recent years.

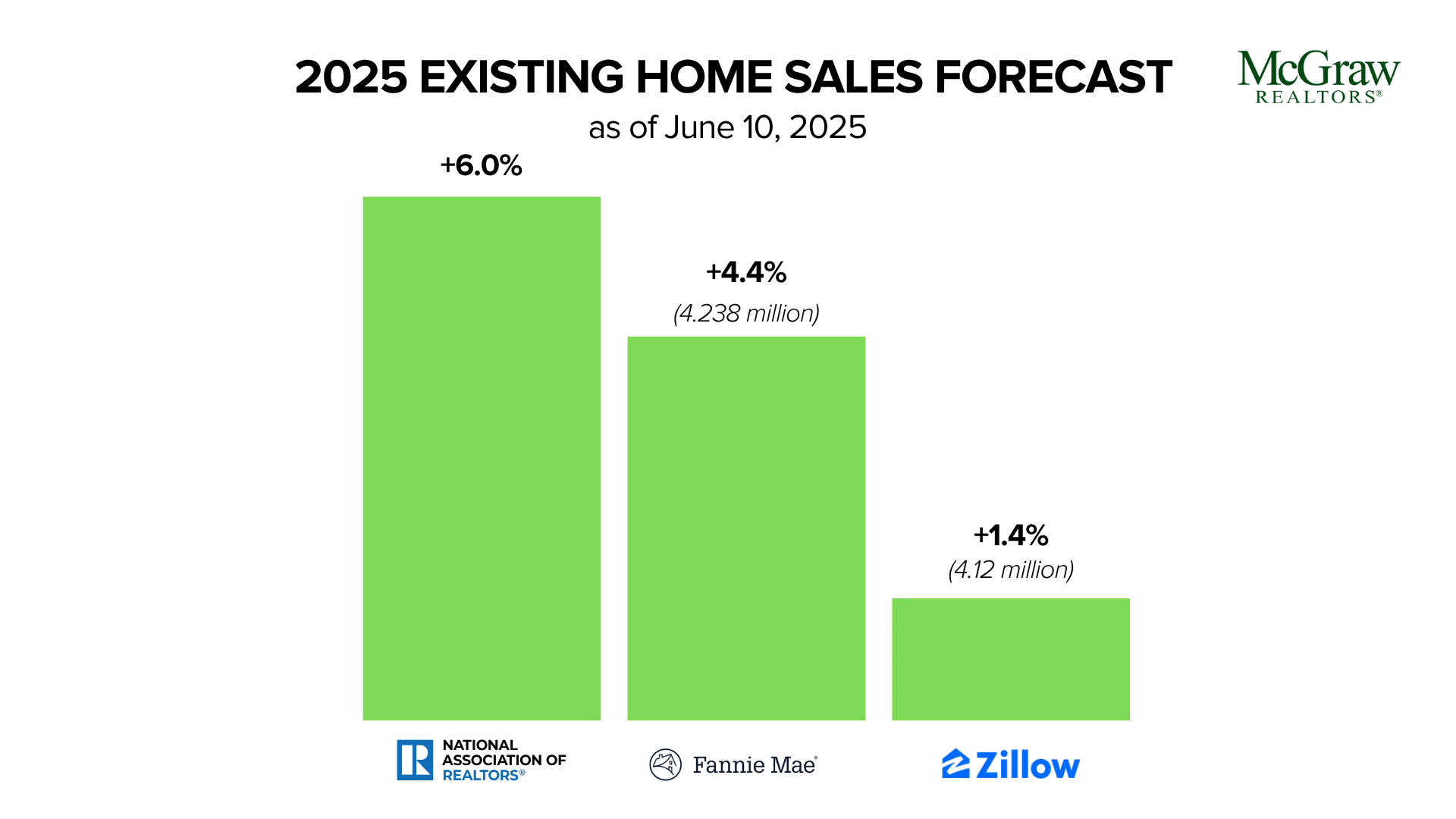

Sales Activity: Picking Up Momentum

Nationally, sales are expected to grow gradually as more inventory hits the market and rates improve:

- NAR: +6% (with another 11% bump expected in 2026)

- Fannie Mae: +4.4%

- MBA: 4.3 million homes

- Zillow: +1.4%

Locally, we’re already seeing more buyers returning to the market here in OKC. Showings are up, and some homes—especially those priced right—are starting to move faster again. While we’re not back to 2021 levels, there’s a noticeable shift in activity.

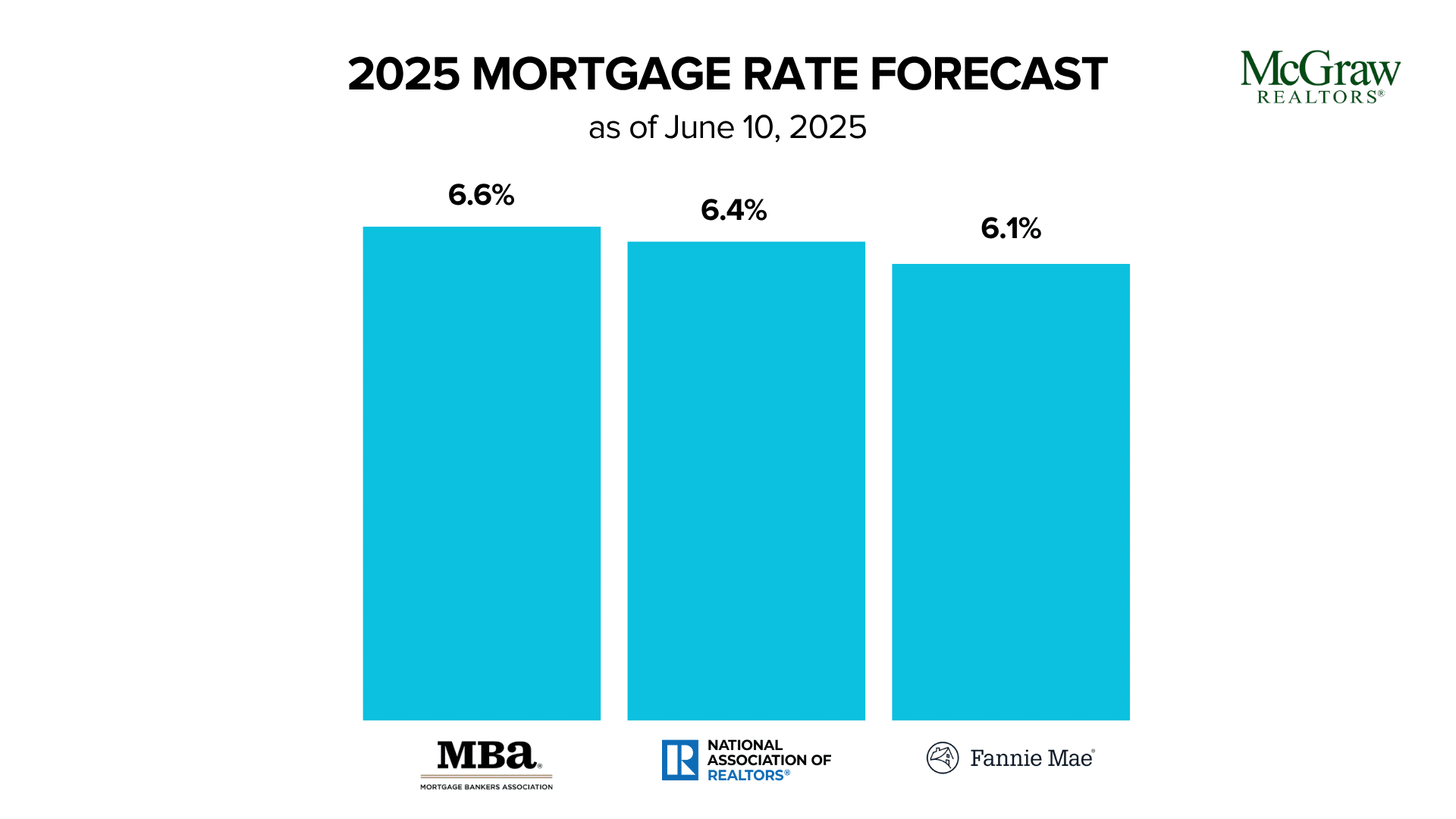

Mortgage Rates: Gradual Dips Ahead

Waiting for sub-5% mortgage rates? Don’t hold your breath. But there is good news—most forecasts expect rates to ease slightly:

- MBA: 6.6% average in Q4 2025; 6.3% in 2026

- NAR: 6.4% by late 2025; 6.1% in 2026

- Fannie Mae: 6.1% by year-end; possibly dipping to 5.8% in 2026

In Oklahoma City, we’re seeing rates hover between 6.25% and 6.5% right now. That’s still higher than what buyers got used to a few years ago, but it’s a move in the right direction—and it’s helping unlock a bit more movement in the market.

Inventory: Still Tight, but Improving

Across the country and right here at home, inventory remains tight—but it’s loosening slightly. We’re seeing more sellers list this summer, which is giving buyers more options and helping balance the market just a bit.

In OKC, we’re not in full-on buyer or seller market territory. It’s more of a neutral zone, where well-priced, well-presented homes are seeing solid activity—especially in certain price ranges.

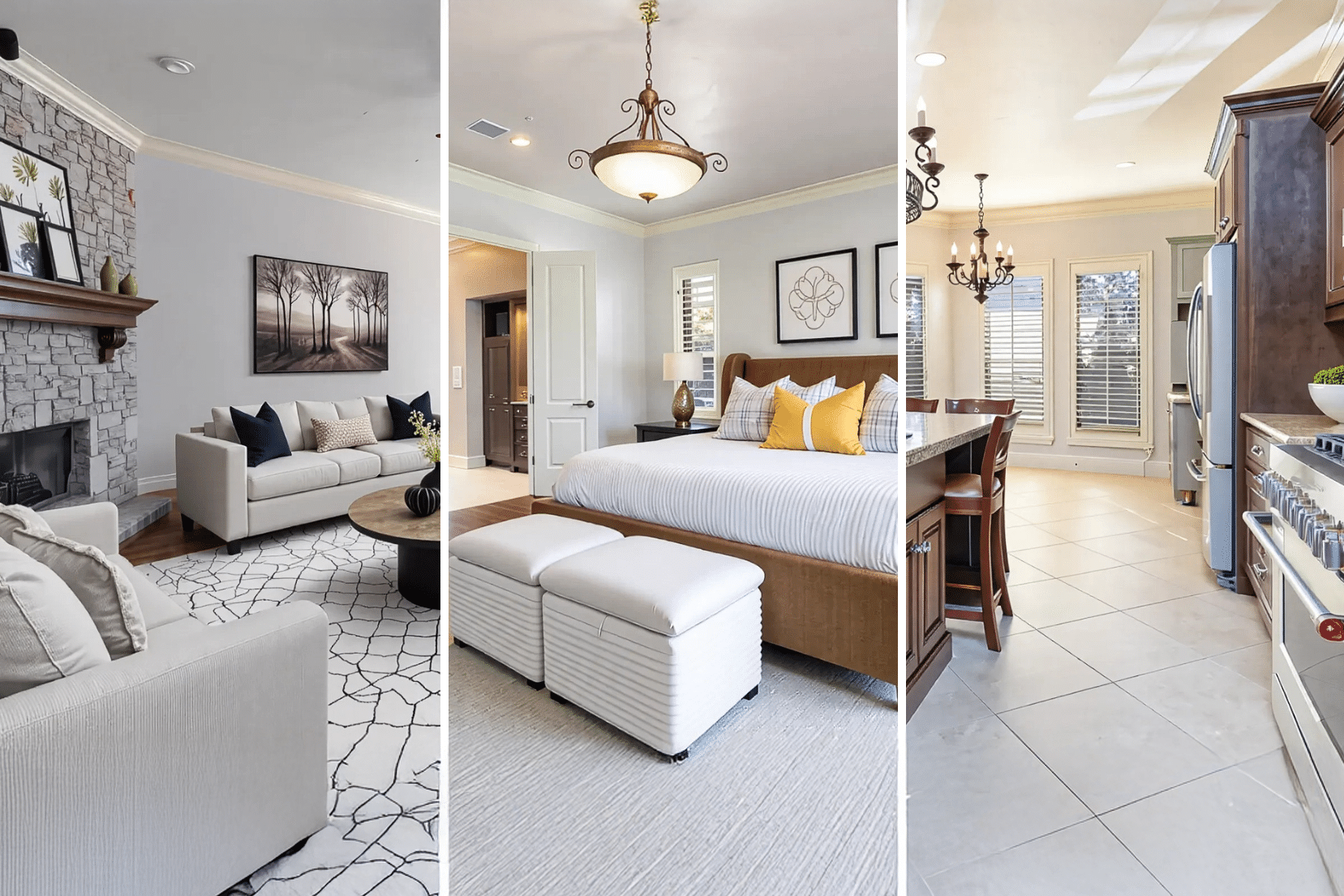

What’s Hot in OKC Right Now?

The $350,000 to $600,000 range is where we’re seeing the most demand—especially for homes that are updated and located in areas with strong school districts. If you’re a seller in this price band, now is a great time to list.

What It All Means

So, what’s the big picture for the rest of 2025?

- Recovery is happening—just gradually.

- Home prices and sales volume are trending upward, but not dramatically.

- Mortgage rates are likely to stay above 6% through the year.

- Realistic expectations (and good preparation) are key for both buyers and sellers.

And remember—while national headlines give us a helpful backdrop, real estate is hyper-local. Even within Oklahoma City, each neighborhood and price point can behave differently.

If you’re wondering what these trends mean for your plans to buy or sell, we’re always here to talk through it. Let’s sit down and see how the second half of 2025 could play out for you.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.