Selling Rental Property: Top Tips for a Smooth Transaction

Selling rental property can be daunting, but it can be a smooth and profitable process with the right preparation. Whether you’re looking to downsize your portfolio or simply move on from a property, there are several tips that can help you sell your rental property successfully.

First, it’s important to consider the condition of your rental property. A well-maintained property will attract more potential buyers and can increase the value of the property. Make sure to address any necessary repairs or upgrades before listing the property. Additionally, consider hiring a professional cleaning service to ensure the property is in top condition for showings.

Another important factor to consider when selling a rental property is the financial implications. Capital gains taxes can be a significant burden, but there are strategies to minimize the impact. For example, a 1031 exchange can allow you to defer taxes by reinvesting the proceeds from the sale into another investment property. It’s important to consult with a tax professional to determine the best strategy for your specific situation.

Understanding the Market When Selling Rental Property

When it comes to selling a rental property, understanding the rental market is crucial. The rental market is affected by various factors, including the job market, rental properties, and real estate investors. Here are a few things to keep in mind when considering the rental market:

- Job market: The job market is one of the most significant factors affecting the rental market. If there are plenty of job opportunities in the area, demand for rental properties will likely be high, which could drive up prices. On the other hand, if there are few job opportunities, demand for rental properties may be low, which could drive down prices.

- Rental properties: The number of rental properties in the area will also affect the rental market. If there are many rental properties available, renters will have more options to choose from, which could drive prices down. Conversely, if few rental properties are available, renters may have to pay more to secure a property.

- Real estate investor: Real estate investors can also play a significant role in the rental market. If many real estate investors buy rental properties in the area, it could drive up prices. However, if there are few real estate investors, prices may be more stable.

For more detailed insights into these factors and their current trends, check out this comprehensive data by Zillow Research.”

Understanding these factors can help you make informed decisions when selling a rental property. By keeping an eye on the job market, rental properties, and real estate investors, you can better understand the rental market and what to expect when selling your property.

Preparing Your Property for Sale

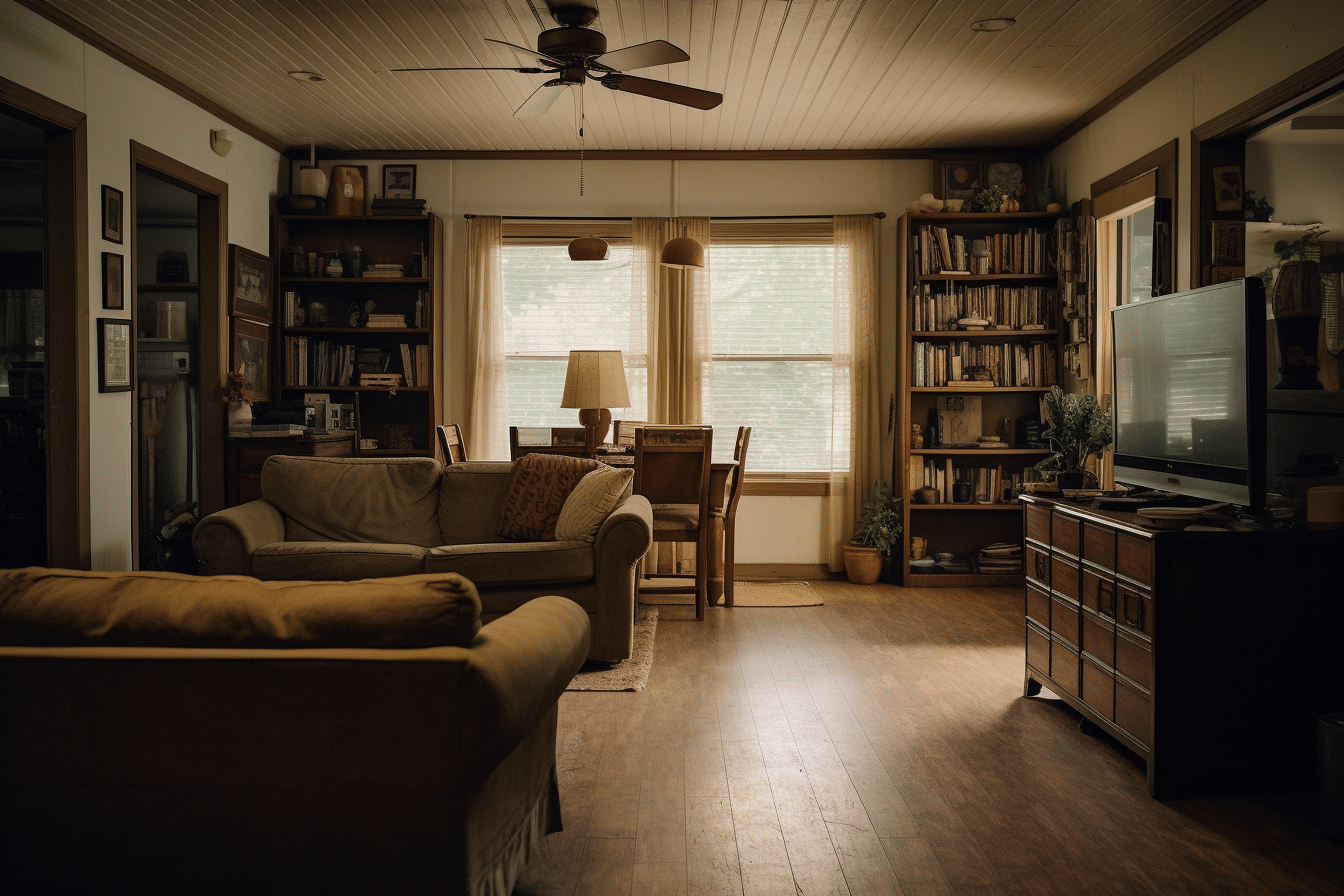

When selling a rental property, it’s essential to ensure that it’s in the best possible condition to attract potential buyers and get the best sale price. Here are some tips to help you prepare your property for sale.

Repairs and Adding Value

Before listing your rental property, you should make any necessary repairs to ensure that it’s in good condition. This includes fixing leaks, replacing broken windows, repairing damaged walls, and ensuring all appliances are in working order. You should also consider making some cosmetic updates to add value to your property. This could include repainting the walls, replacing old fixtures, or updating the landscaping.

By making these repairs and updates, you can increase the value of your rental property and make it more attractive to potential buyers. This can help you sell your property faster and for a higher price.

Marketing Your Property

Once your rental property is in good condition, it’s time to start marketing it to potential buyers. You should begin by taking high-quality photos of your property and creating a detailed listing that highlights its selling points. This could include features such as a large backyard, updated appliances, or a desirable location.

You should also consider hosting an open house or virtual tour to allow potential buyers to see your property in person. This can help them better understand the property’s layout and features and increase their interest in making an offer.

When marketing your rental property, it’s essential to be honest and transparent about any issues or repairs that need to be made. This can help you build trust with potential buyers and ensure that the sale process goes smoothly.

By following these tips, you can prepare your rental property for sale and increase your chances of getting a great sale price.

Working with Real Estate Professionals

Collaborating with a reliable real estate professional such as OKCHomeSellers when considering selling your rental property can be incredibly beneficial. The expertise of an experienced team like OKCHomeSellers can help you navigate through the complexities of the selling process and ensure you obtain the best possible price for your property. Here are some tips for your successful collaboration with real estate professionals and OKCHomeSellers:

- Seek the expertise of agents with experience in selling rental properties. An agency like OKCHomeSellers, with a proven track record in selling similar properties, is invaluable. They possess in-depth knowledge of the local market and a keen understanding of the rental property market dynamics.

- Understand the intricacies of commission. Real estate professionals, including OKCHomeSellers, typically charge a commission on the sale of a property, usually expressed as a percentage of the sale price. This commission gets divided between the buyer’s and the seller’s agents. Ensure you’re fully aware of how the commission works and what you’ll be expected to pay.

- Be explicit about your objectives. Prior to engaging with a team like OKCHomeSellers, clarify your objectives for selling your property. Whether your priority is maximizing profit or facilitating a quick sale, it’s crucial that your agent is aware of your goals to effectively assist you in meeting them.

- Maintain regular communication with your agent. Navigating the sale of a rental property can be a complex process, and staying in constant contact with your agent, such as those at OKCHomeSellers, is crucial. Be available to answer their queries and keep them updated on any changes in your circumstances.

Collaborating with a real estate professional particularly with a reputable team like OKCHomeSellers, can greatly enhance your experience and success when selling a rental property. By seeking the expertise of experienced agents, understanding the commission structure, setting clear objectives, and maintaining regular communication, you can secure the best possible price for your property.

Lease Considerations

When you’re selling a rental property, the lease is one of the most important considerations. Here are some key things to keep in mind when navigating lease considerations.

Dealing with Tenants

First, you must consider your tenants when selling a rental property. You cannot simply vacate them from the property if they have a fixed-term lease. If they have a month-to-month lease, you may be able to give them notice to vacate, but you still need to give them adequate notice and follow the proper legal procedures.

Being transparent with your tenants about your plans to sell the property is important. They may have questions about their lease, their security deposit, or other concerns. Be prepared to answer their questions and provide them with any necessary information.

Lease Period and Expiration

The lease period and expiration are also important considerations when selling a rental property. If the lease is set to expire soon, you may want to wait until it does before putting the property on the market. This will make it easier to show the property to potential buyers and avoid any complications with the lease.

If the lease has a long time left before it expires, you may need to work with the tenant to come up with a plan for showing the property. This could involve scheduling showings around the tenant’s schedule or offering incentives for the tenant to vacate the property early.

Overall, it’s important to be aware of the lease and how it will impact the sale of your rental property. You can ensure a smooth and successful sale by working with your tenants and understanding the lease terms.

Understanding Capital Gains

When selling a rental property, it’s important to understand capital gains and their associated taxes. Capital gains are the profits you make from the sale of an asset, such as a rental property.

Capital Gains Tax

Capital gains tax is the tax you pay on the profits you make from selling your rental property. The amount of tax you owe depends on your filing status and taxable income. If you’re married and filing jointly with a taxable income between $83,350 and $517,200, the capital gains tax rate is 15%.

There are various methods of reducing capital gains tax, including holding onto the property for more than a year to qualify for the long-term capital gains tax rate, which is generally lower than the short-term rate. You may also be able to take advantage of tax deductions, such as depreciation and expenses related to the sale of the property.

Depreciation Recapture

Depreciation is the reduction in the value of your rental property over time due to wear and tear. When you sell your rental property, you may have to pay depreciation recapture tax on the amount of depreciation you claimed while you owned the property.

The depreciation recapture tax rate is 25%, which is higher than the long-term capital gains tax rate. However, you may be able to reduce your depreciation recapture tax by taking advantage of tax deductions and credits.

It is important to understand the tax implications of selling your rental property before you put it on the market. By taking steps to reduce your capital gains tax and depreciation recapture tax, you can maximize your profits and minimize your tax burden.

Tax Implications and Deductions

Selling rental property comes with tax implications that you need to be aware of. Understanding the tax rate and taxable income associated with selling rental property is important. The IRS taxes the profit you made selling your rental property in two different ways: capital gains tax rate and depreciation recapture tax rate.

The capital gains tax rate is dependent on your filing status and taxable income. For those who are married and filing jointly, the capital gains tax rate can fall into one of three categories – a lower, middle, or upper rate. The lower rate applies if your taxable income falls below a certain threshold; the middle rate is for incomes within a specified range, while the upper rate applies to incomes exceeding a predetermined threshold. Please consult your tax advisor or the IRS website for the specific income thresholds applicable to your situation.

The depreciation recapture tax rate is another tax implication that you need to consider when selling rental property. This tax rate is fixed at 25% and applies to the depreciation you claimed while you owned the property.

Fortunately, there are various methods of reducing capital gains tax, including deductions. You can deduct expenses related to the sale of your rental property from your taxable income. Here are some common deductions that you can consider:

- Real estate commission

- Advertising expenses

- Legal fees

- Home improvement expenses

- Property management fees

- Insurance premiums

- Travel expenses related to the sale of the property

- Tax preparation fees

It is important to note that not all expenses related to the sale of your rental property are deductible. For example, you cannot deduct the cost of repairs or maintenance that you made to the property while you owned it.

To ensure that you take advantage of all the deductions available to you, consider consulting a tax professional. A tax professional can help you navigate the tax implications of selling rental property and make sure that you are taking advantage of all the deductions available to you.

Financing and Mortgage Considerations

When it comes to selling a rental property, financing and mortgage considerations are crucial. It’s important to understand your options and choose the one that best fits your needs.

Mortgage Options

If you have a mortgage on your rental property, you’ll need to pay it off when you sell. You have a few options when it comes to paying off your mortgage:

- Pay off the mortgage with the proceeds from the sale. This is the most common option. You’ll use the money you make from selling the property to pay off the remaining balance on your mortgage.

- Transfer the mortgage to the buyer. In some cases, you may be able to transfer your mortgage to the buyer. This can be a good option if you have a low-interest rate on your mortgage and the buyer is willing to take on the payments.

- Sell the property subject to the mortgage. This option is rare but worth considering if you’re having trouble finding a buyer. Essentially, you’ll be selling the property with the mortgage still in place. The buyer will take over the payments, and you’ll receive the remaining proceeds from the sale.

Financing Options

If you’re buying a rental property, you’ll need to consider your financing options. Here are a few things to keep in mind:

- Conventional loans. These are the most common types of financing for rental properties. They’re not guaranteed by the government and may require a slightly larger down payment than other options.

- FHA loans. These loans are backed by the Federal Housing Administration and are designed for first-time homebuyers. They typically require a lower down payment than conventional loans.

- VA loans. These loans are available to veterans and active-duty military members. They offer competitive interest rates and may not require a down payment.

Seller Financing

Seller financing is when the person who is selling the property finances the purchase. This can be a good option if you’re having trouble finding a buyer or if you want to earn more interest on the sale. However, it’s important to be aware of the risks involved. If the buyer defaults on the loan, you may have to foreclose on the property. It’s also important to ensure you comply with all applicable laws and regulations.

1031 Exchange and Like-Kind Properties

When selling your investment property, you may want to consider a 1031 exchange to defer capital gains taxes. A 1031 exchange, named after section 1031 of the U.S. Internal Revenue Code, allows you to sell your investment property and use the proceeds to purchase a like-kind property without paying taxes on the gains.

To qualify for a 1031 exchange, the property sold and purchased must be considered like-kind. This means that both properties must be used for investment purposes, such as rental properties or commercial buildings. The properties do not have to be identical, but they must be of the same nature or character. For example, you can exchange a single-family home for a multi-family one.

It is important to note that a 1031 exchange is not a tax-free transaction, but rather a tax-deferred transaction. This means you will still have to pay taxes on the gains when you sell the like-kind property you purchased through the exchange, unless you do another 1031 exchange.

When considering a 1031 exchange, working with a qualified intermediary who can help you navigate the process and ensure that you meet all the requirements is important. Additionally, you must identify the replacement property within 45 days of selling your original property and complete the exchange within 180 days.

A 1031 exchange can be useful for deferring capital gains taxes when selling investment property. However, it is important to carefully consider all the requirements and work with a professional to ensure that you comply with all the rules and regulations.

Profit, Loss, and Cash Flow

When selling a rental property, it’s important to understand the financial aspects of the transaction. This includes profit, loss, and cash flow. Here’s what you need to know:

Profit

Profit is the amount of money you make when you sell your rental property. To calculate your profit, subtract your selling expenses and your adjusted basis from the selling price. Your adjusted basis is the amount you paid for the property, plus any improvements you made, minus any depreciation you took.

You have a profit if your selling price is higher than your adjusted basis and selling expenses. If your selling price is lower than your adjusted basis and selling expenses, you have a loss.

Loss

If you sell your rental property for less than you paid for it, you will have a loss. This loss can be used to offset other capital gains you may have. If you have no other capital gains, you can use up to $3,000 of your loss to offset your ordinary income. Any loss you can’t use this year can be carried to future years.

Cash Flow

Cash flow is the amount of money you receive from your rental property after you’ve paid all of your expenses. This includes your mortgage payment, property taxes, insurance, repairs, and any other expenses you may have. To calculate your cash flow, subtract your expenses from your rental income.

A positive cash flow means that you’re making money from your rental property. A negative cash flow means that you’re losing money. If you have a negative cash flow, you may need to increase your rental income or decrease your expenses to make your property profitable.

In conclusion, understanding profit, loss, and cash flow is crucial when selling a rental property. Make sure you calculate these figures accurately and take them into consideration when deciding whether to sell your property.

Closing the Sale

Congratulations! You’ve found a buyer for your rental property. Now it’s time to close the sale. Here are some tips to help you navigate this final stage of the process:

- Be prepared to negotiate: Even if you’ve agreed on a price with the buyer, other issues may arise during the closing process that require negotiation. For example, the buyer may request repairs or concessions based on the results of the inspection. Be prepared to negotiate in good faith to ensure that the sale goes through.

- Understand your cost basis: Your cost basis is the amount of money you’ve invested in the property, including the purchase price and any improvements you’ve made. Understanding your cost basis is important because it will determine how much capital gains tax you will owe on the sale. Be sure to consult with a tax professional to ensure that you understand your tax obligations.

- Disclose any issues: It’s important to disclose any issues with the property to the buyer before closing. This includes any defects or problems with the property and any issues with tenants or rental income. Failure to disclose these issues could result in legal action against you.

- Consider your options for reinvesting: If you’re selling a rental property as part of a larger investment strategy, it’s important to consider your options for reinvesting the proceeds. This may include purchasing another rental property, investing in stocks or other assets, or using the funds to pay off debt or save for retirement.

By following these tips, you can ensure that the closing process goes smoothly and that you’re able to maximize the value of your rental property sale.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.