How to Help Your Kid Buy a Home (Without Creating a Tax Mess or Family Drama)

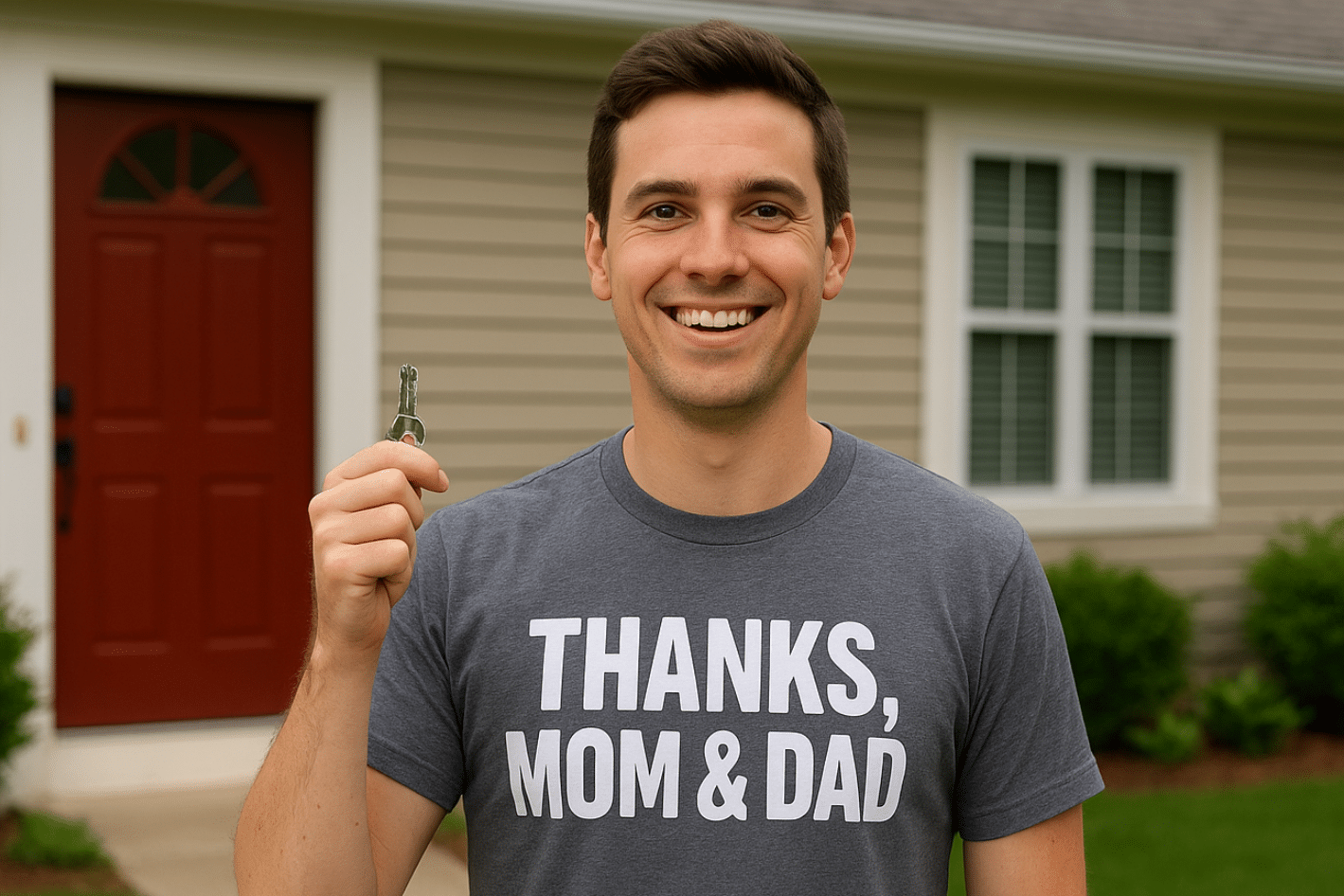

Thinking about ways to help your kid buy a home of their own? You’re not alone—and you’re definitely not crazy. With housing prices and mortgage rates staying sky-high, buying a first home in today’s market is a serious challenge. It’s no wonder more parents are stepping in to give their kids a hand.

In fact, recent data from Redfin shows nearly one in four Gen Z and Millennial buyers used family money—either as a gift or inheritance—to help with their home purchase. Whether it’s helping with a down payment, co-signing a loan, or even gifting a whole property, more families are treating real estate support as part of long-term financial planning.

But here’s the thing: even the most well-intentioned gift can go sideways if you don’t structure it correctly.

From surprise tax bills to title tangles and sibling resentment, I’ve seen families end up in tough spots just because they didn’t map things out ahead of time. Let’s make sure you don’t end up in that boat.

Here’s a breakdown of the best ways to help your child with real estate—plus three common missteps you’ll definitely want to avoid.

3 Smart Ways to Help Your Kid Buy a Home

1. Give Cash (Up to the Annual Limit)

The simplest (and cleanest) option? Just give your kid money. As of 2025, you can gift up to $19,000 per person—or $38,000 as a couple—each year without needing to file a gift tax return. Go above that, and it starts chipping away at your lifetime exemption (currently $13.99 million per person), but no actual taxes are due unless you exceed that threshold.

If your child’s getting a mortgage, they’ll just need a letter confirming it’s a gift, not a loan. That one letter can save a lot of confusion.

2. Lend Them the Money (With a Formal Loan)

Want them to take ownership (literally and financially)? Consider becoming the bank. You can structure a loan with terms that meet IRS guidelines—interest rates, a repayment schedule, and all the legal trimmings—and let them pay you back over time.

Even better, you can forgive part of the loan each year within that $19K annual gift allowance. It’s a great way to offer support while still teaching responsibility—and staying compliant.

Just make sure you document everything properly. Have an estate attorney or CPA draft the paperwork so there’s no ambiguity.

3. Use a Trust to Transfer Real Estate

Thinking of gifting an entire property? A trust might be your best move. And no, they’re not just for ultra-wealthy families.

There are two common types:

- Revocable Trusts: These are flexible and allow you to make changes during your lifetime. They’re perfect if you want your kid to inherit real estate without it going through probate.

- Irrevocable Trusts: Less flexible but better for protecting assets, reducing estate taxes, and planning for long-term use or co-ownership (like siblings sharing a vacation home).

Trusts are especially helpful if you want to set specific rules—like who can live in the home, what happens if it’s sold, or how income is divided.

3 Common Mistakes That Can Backfire

1. Putting Your Child on the Deed

It may seem like a quick fix, but adding your kid directly to the deed can come with big tax consequences. For starters, they’ll take on your original cost basis—so if they sell later, they could face a hefty capital gains tax.

It also complicates your control. Want to refinance? Need to sell? You might need their permission. Not to mention, if they go through a divorce or get sued, the house could be at risk.

2. Relying Only on a Will

Yes, you can pass real estate through a will. But doing so sends the entire property into probate—a slow, public, and often expensive legal process.

A will also doesn’t offer protection from taxes, disputes, or creditors. A trust can do all of that, and it allows you to set clear expectations for how the property should be used or distributed.

3. Selling the Property for $1

It’s a common idea: “Just sell the house to my kid for a buck.” Unfortunately, the IRS isn’t amused.

They treat it as a gift anyway—and your child inherits your tax basis, not the current value. That means no tax advantage, and a messy paper trail if anything ever comes under scrutiny.

Bottom line: it’s the worst of both worlds. Don’t do it.

Wrapping Up

Helping your child step into homeownership is a generous move—and one that can have lasting impact. But the how matters just as much as the what.

When done right, you’re not just giving your kid a home. You’re giving them a head start and building a strong foundation for their financial future.

Have questions or need help connecting with the right professionals—like estate planners, CPAs, or trusted lenders? I’d be happy to point you in the right direction.

Because when you give wisely, you don’t just hand off a house—you pass on peace of mind.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.