Should You Buy a Home in a Slowing Economy? Here’s What Smart Buyers Are Doing in 2025

With the economy showing signs of slowing, mortgage rates remaining elevated, and home prices appearing stagnant, it’s understandable if you’re feeling cautious about buying a home in a slowing economy 2025. Many potential buyers are adopting a “wait and see” approach, hoping for clearer signals before making a significant investment.

Recent reports indicate a 0.3% decline in the U.S. GDP for Q1 2025, following a robust 2.4% growth at the end of 2024. Such economic indicators naturally prompt hesitation.

However, while some are pausing, informed buyers are taking proactive steps: asking pertinent questions, analyzing data, and formulating strategic plans.

A Three-Step Guide for Prospective Buyers in 2025

Understanding the Impact of Buying a Home in a Slowing Economy 2025

If you’re uncertain about entering the housing market, consider this straightforward approach to navigate your decision-making process.

1️⃣ Identify Your Specific Concerns

It’s common to hear sentiments like:

“I’m thinking of waiting to see how the economy unfolds. I don’t want to make a misstep.”

This apprehension is valid. Purchasing a home is a significant commitment, and economic uncertainty can amplify doubts.

Instead of remaining in a state of indecision, delve deeper: What exactly is causing your hesitation?

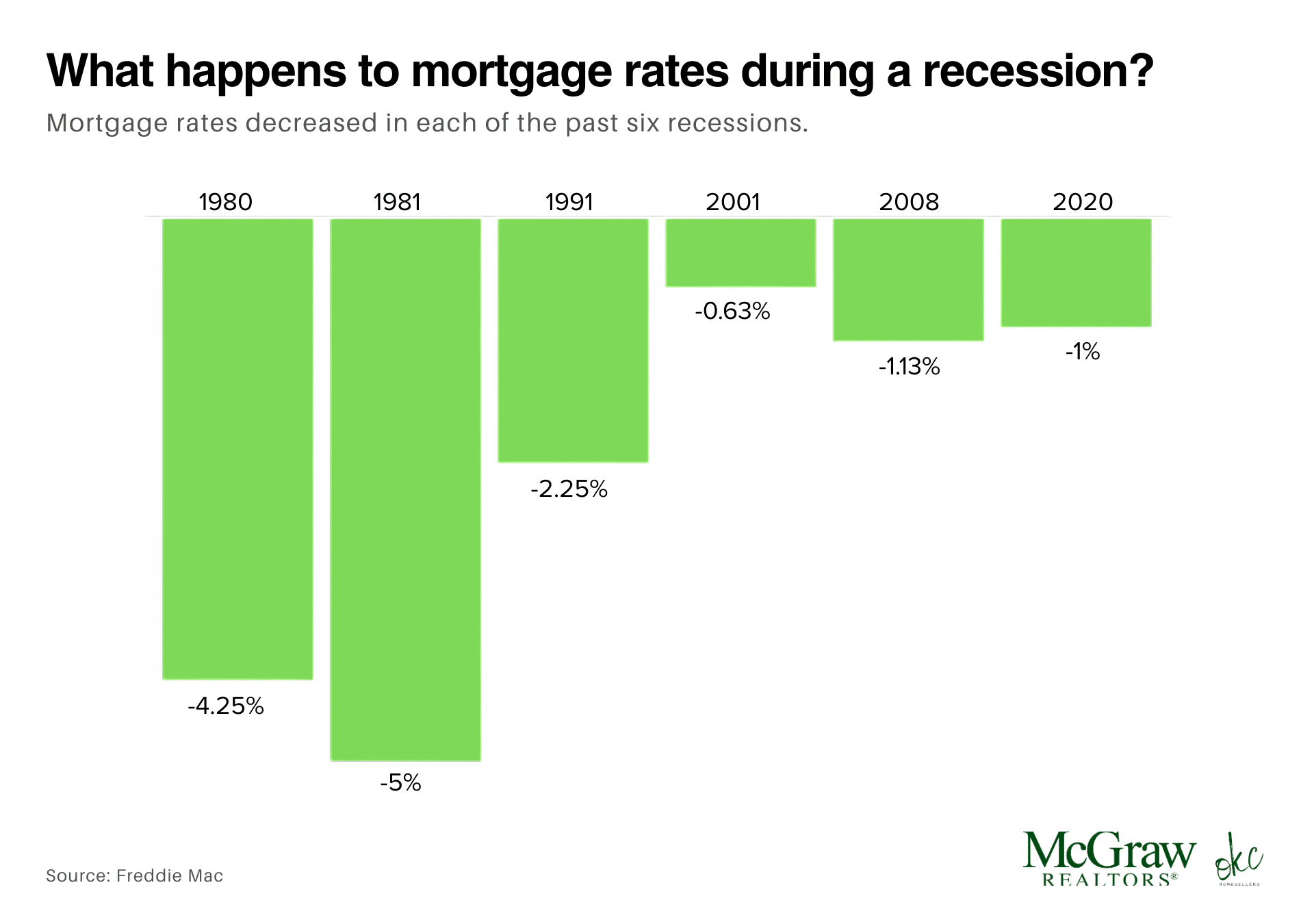

- Are you concerned about rising interest rates?

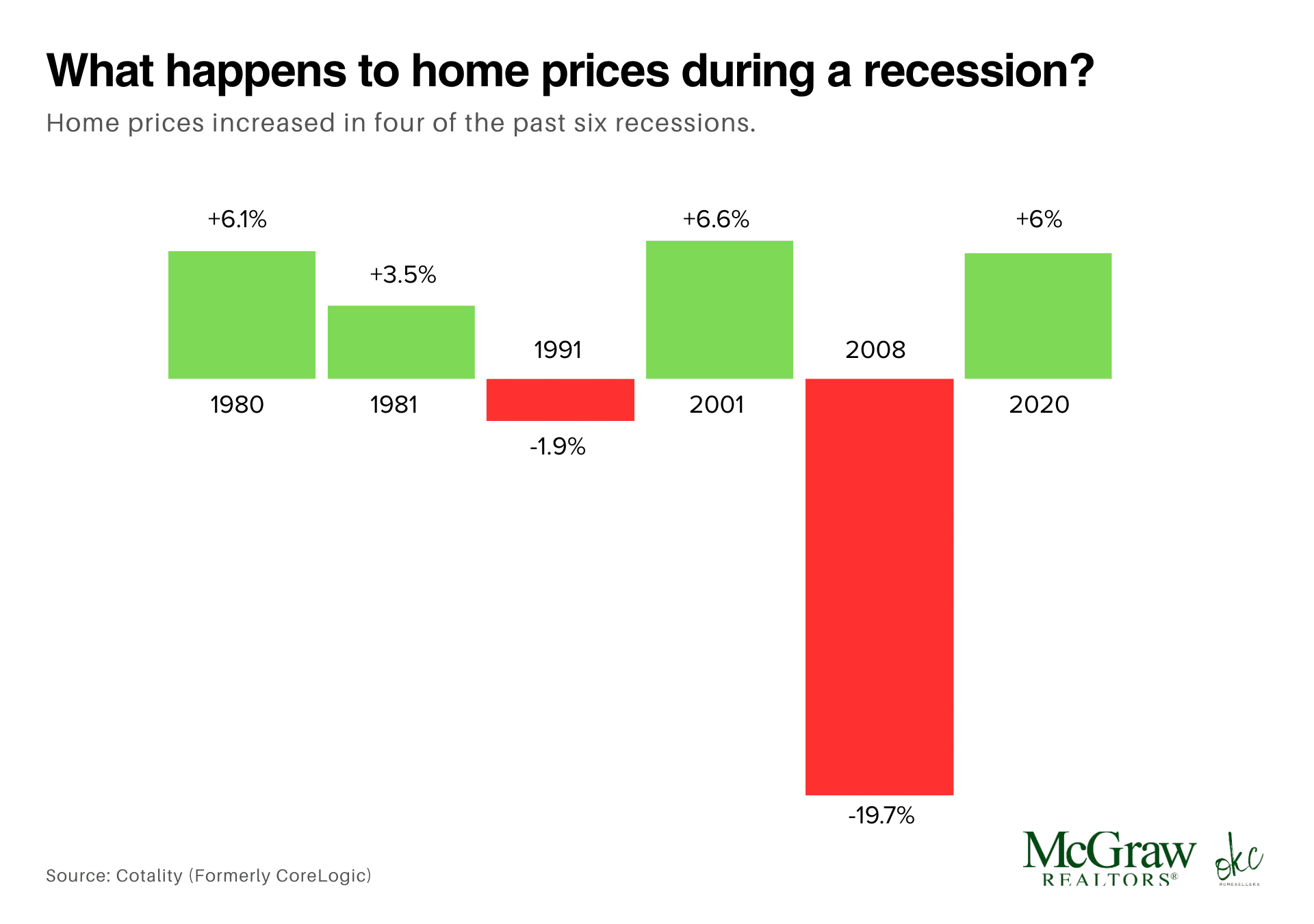

- Do you fear a potential drop in home prices?

- Is job stability a factor?

- Are you unsure about the timing?

By pinpointing the root of your concerns, you can address them directly and make decisions grounded in facts rather than fears.

2️⃣ Analyze the Current Market Dynamics

Assumptions abound that home prices will plummet or that interest rates will soon decrease. However, current data paints a different picture.

National Trends (April 2025):

- Inventory has increased by 30.6% year-over-year, offering buyers more options and reducing competition.

- 18% of listings experienced price reductions, the highest for any April since at least 2016, indicating sellers are adjusting expectations.

- Homes are staying on the market longer, with a median of 50 days, providing buyers more time to make decisions.

- The national median list price remains steady at $431,250, with a modest 1.1% increase in price per square foot, suggesting price stability.

Oklahoma City Specifics (April 2025):

- Median sold price: $326,103, marking a 2.1% increase from the previous year.

- Average days on market: 48 days, up from 36 days a year ago, indicating a slight slowdown in sales pace.

- Homes sold below asking price: Approximately 45% of homes sold for less than the asking price, suggesting room for negotiation.

These insights reveal that while the market isn’t experiencing a downturn akin to 2008, there are opportunities for buyers who are prepared and informed.

3️⃣ Develop a Strategic Plan

Regardless of your intended timeline, having a clear plan is crucial.

If you’re aiming to purchase within the next 18 months, consider these options:

- Option 1: Continue renting for 6–12 months, during which you can save, monitor market trends, and prepare for a future purchase.

- Option 2: Explore current listings to identify potential opportunities, especially as some sellers may be more willing to negotiate in the current climate.

Both paths have their merits; the key is aligning your choice with your personal circumstances and financial goals.

Final Thoughts

Economic uncertainty can be daunting, but it doesn’t necessitate inaction. By focusing on concrete data, understanding your personal concerns, and crafting a well-thought-out plan, you can navigate the housing market with confidence.

If you need assistance analyzing your options or understanding the local market nuances, feel free to reach out. I’m here to help you make informed decisions every step of the way.

Luxury Specialist at McGraw Realtors

With a diverse background, including a career as an Air Force fighter pilot and entrepreneurship, Bill transitioned to real estate in 1995. Co-founding Paradigm Realty with his wife, Charlene, he quickly rose to prominence in Oklahoma City’s luxury real estate scene. Now, as one of the top agents with annual sales surpassing $20 million, Bill’s dedication to exceptional service remains unparalleled. With a legacy spanning over two decades in the industry, Bill’s expertise and commitment make him a trusted name in luxury real estate.